Market Update – October 2021

18/10/2021

Market Update – November 2021

13/12/2021Issue 17, October 2021

From the MDs' Desk

Welcome to our 17th edition of Affinity Insights.

Affinity recently celebrated its 10 year Anniversary and we as a business have gone from strength to strength. We have attracted a fantastic and highly credentialed team which has culminated in us having a great culture to deliver outstanding independent financial advice, truly free from any conflict of interest or influences.

Over the last 3 years, we have conducted over 1000 client meetings, implemented an industry leading technology platform, established a market leading investment service, relocated to our exquisite Collins St office (that we have hardly used) and now have been running our own Australian Financial Services Licence for a little over 12 months – it’s been a big 3 years.

We are very proud of our team and each of their individual contributions to Affinity, and humbled by our client’s patronage and the influx of referrals we have been provided over the last 12 months. We thank you all who have actively referred their friends and family to us as we have more than enough capacity to take on more clients. Thank you!

We are really looking forward to meeting you all again in person, as zoom has achieved business continuity, although nothing replaces the one on one interactions we have with each of you.

As the festive season is fast approaching, we thought it appropriate to advise our summer holiday hours. The office will close on Thursday 23rd December, 2021 at 12noon and re-open on Monday, 17th January, 2022 at 9am. For any urgent queries during this period please call Rodney on 0488 993 175 or Tony on 0421 344 238.

We do hope you enjoy this issue of Affinity Insights and we welcome any feedback or suggestions for future topics.

From Rodney M. DeGabriele and Tony Vikram

Kathy Chan

We are delighted to announce that Kathy Chan joined Rodney DeGabriele, Tony Vikram and Alison Warner in an advisory capacity on 3 September 2021.

Kathy became a part of the Affinity team at the beginning of this year and has proven her dedication to her ongoing development. With a Certified Financial Planner (CFP) qualification and over 7 years working in the financial services industry, Kathy has gained a holistic perspective of wealth management and is dedicated to making a positive impact on clients’ lives.

Congratulations Kathy, we could not be more excited to share this experience with you!

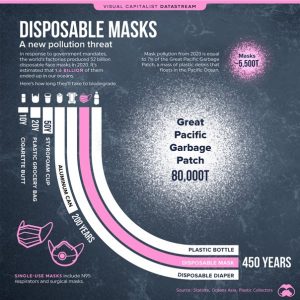

Why COVID-19 is impacting our Oceans

In 2020, nearly 1.6 of the 52 billion disposable face masks produced were found in our oceans which amounts to approximately 5,500 tons of plastic pollutions.

The masks being produced are commonly made of polypropylene can easily be broken down into microplastics which are commonly found in our water supply.

Disposable masks are expected to take over four centuries to decompose in the ocean which is the equivalent to plastic bottles and disposable diapers:

The pandemic has extended well into 2021, and the number of disposable masks polluting our oceans is likely to continue growing. It is therefore imperative we consider this and invest in reusable masks.

Read the full article here.

Miss M Sweets

Missy M Sweets is a local baking business based in Perth, WA that offers freshly handmade sweets and custom-made dessert gift boxes that have Asian inspired flavours. Their brand has a strong sense of community within the City of South Perth and aims to collaborate with as many local businesses within the area as possible.

Missy M Sweets’ mission is to partner with social enterprises/non-profit organisations to support the social enterprise component of the business. The founder, Maryann is passionate about helping others and hopes to eventually launch “The Baking Circle” – a hub that will allow Maryann to connect, network, educate and serve the community in conducting baking workshops with underprivileged women. This is in the hope of helping them find work in the baking industry, or to start their own baking business if they so wish. The latter will also include business school and training in conjunction with Global Sisters.

Click here to explore their range of sweets.

Advised clients 5.2% better off

According to Russell Investments, an advisers’ biggest contribution to clients is their behavioural coaching role, specifically after the onset of COVID-19.

During the pandemic, a key mistake a lot of unadvised investors made was abandoning their existing long-term investment strategies and sell out of their portfolio holdings after the dramatic market decline which caused them to miss out on the investment gains once the market recovered. Whereas, advised investors are continuously educated by market volatility and have a greater understanding and level of comfort with the fact that there will naturally be ups and downs along their finical journey.

According to the Financial Standard, research shows that advised clients’ portfolios benefit by approximately 5.2% based on the following factors – financial advisers were able to prevent behavioural errors (2%); recommend appropriate asset allocation (1.1%); optimise cash holdings (0.6%); and advise on tax-effective investing and planning (1.5%).

Russell Investments director and head of business solutions Bronwyn Yates said “The value of an adviser is far greater than just placing clients’ money into investment products and updating them on their progress. Beyond the material value of financial advice, the peace of mind and comfort that advisers provide clients is critical, and it is important for advisers to be able to clearly communicate those benefits.”

Reference: Vergara, Karren. Financial Standard.

Market Update - October 2021

The Australian housing market is a source of endless barbeque conversation and media pontification. Potential first home buyers complain that they are perpetually priced out of the market. Established buyers retort that interest rates are significantly lower than when they purchased their first property. In this Insight, we unpack the Australian housing market, with a particular focus on affordability.

Our latest Market Update is now available to view here.

Coming out of Lockdown

Consider this scenario: It is the start of 2020. You have been sticking to your New Year’s resolutions and making slow but steady progress in developing new strategies for healthy habits, and just starting to reap the rewards from all your concerted efforts. Yes, things had been going pretty well for a while there! But then something unexpected happened: a global lockdown amidst the Covid-19 pandemic.

Upheavals in the organisations that we work for changed our roles almost overnight. Some of us were made redundant, some were furloughed, whilst others needed to quickly adapt to new ways of working remotely, perhaps even with an increased workload. Gone was the daily commute to work and our social lives as we knew it, only to be replaced by disrupted day to day routines, with us trying to juggle all our families’ needs, and external activities now having to take place under one roof.

By anyone’s reckoning, it has been a very challenging 2 years. Life happened to all of us. Loss of contact with family members, separation, fear, pain, depression, concerns, and worries. We must not be naive in thinking that our physical selves are somehow immune to the emotional and psychological shifts that we have gone/are going through.

On balance most of us would have succumbed to an overall level of decreased general physical activity as a result of being mostly at home during lockdown. Simply put, we have been moving far less than we used to when we were at work. When at home, we have reduced interaction with colleagues and reduced need for all the ‘incidental’ movement that usually occurs en route to work, and when we are at work.

Over the past weeks and months, this insidious reduction in regular and sometimes sustained general movement, depending upon what our job tasks were, would have resulted in physical deconditioning. In other words, our bodies would have gradually gotten accustomed to, and adapted to undergoing less physical activity. When we move less, our physical condition declines. As a result, we may feel as though we have lost ground in our overall fitness. As stated in his blog, Ash James mentions that this is potentially the most important factor regarding our physical health in the transition from daily working to staying at home during lockdown.

What is deconditioning?