Scientist Leonie Walsh on taking career risks for personal priorities

10/08/2017

Market Update – August 2017

25/08/2017Issue 1, August 2017

From the MD’s Desk

Welcome to the first edition of Affinity Insights. It is with great pleasure that I confirm that the consolidation of the two businesses, Affinity Private and Privatis Partners, is now complete.

We worked tirelessly as a team to bring the smarts and technological components together to enable enhanced service and advice capability moving forward for the benefit of all our clients. There are a series of additional services and initiatives we will be adding in 2017 and changes to the way we interact with you to better serve, guide and support you, in a more timely and efficient manner.

The very first initiative, has been the total redevelopment of our website. I urge you to spend 5 mins perusing it at your leisure. Moving forward, we will now begin posting regular updates to you on relevant economic, market and other topical information that will be of interest.

The second initiative, is the use of ShareFile. ShareFile is the most commonly used secure file sharing solution used by some of the largest global companies across North America. Expect an email from our client services team detailing how to login to your private and secure file. ShareFile will enable us to share files to one another without the need and dependency of emails; with no file size limitations and all within a secure area. We have introduced this protective measure due to the increase in identity fraud originated amongst financial institutions across Australia. We searched long and hard for this solution, and feel it’s the one best suited to protect your data and interests.

I do hope you like our first issue, and we welcome any feedback or suggestions for future topics.

Please send all comments to: enquiries@affinityprivate.com.au

Our Opinion

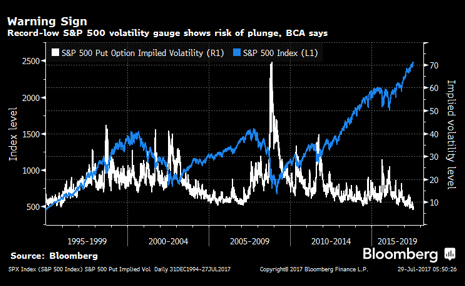

A ‘defensive’ portfolio stance is still justified

The historically unprecedented disconnect between implied volatility and prices (as illustrated by the chart below) continues to exercise our minds.The best way to protect your carefully constructed portfolio is to create it from a long term strategic defensive standpoint. Risk management should be a top priority to guard against market complacencies and risks as well as inaccurate valuations.

The surge of market returns based on low interest rates and major asset purchases by the banks are disconcerting. Combined with President Trump’s push for lower corporate taxes and higher infrastructure spending has only further inflated a reckless pursuit of returns; replacing the economic practices based on tried and true principles.

Our defensive standpoint has been achieved in various ways; namely maintaining a low exposure to local and international equities as well as implementing a dollar cost averaging strategy to average out the buy prices of equity portfolios over a longer time frame than usual. This is evident in the sizeable cash values being held in our portfolios; including those of managers with the authority to hold cash in the effort to control risk.

These measures, while not guaranteeing positive outcomes in unstable share market conditions, do provide some protection from worst-case scenarios.

Introducing your Support Team

Alison Warner – Associate

Alison has an extensive background working as an Associate and in senior managerial roles within professional financial advisory and accountancy firms.

Alison has worked alongside Directors, Executive Planners and Senior Accountants developing her understanding of superannuation including SMSF, trustee structuring, corporate structuring, tax planning, investment advice, retirement planning, risk and asset protection and intergenerational estate planning.

Alison cares about our clients and the work that she does for them. Alison has a Diploma of Financial Planning, a Master of Business (Professional Accounting), a Graduate Diploma of Business Human Resource Management / Industrial Relations and a Bachelor of Arts.

Kelli Sanders – Client Operations

Kelli has been working in Financial Services for the last 20 years in Client Service facing roles.

During this time, she has worked for Fund Managers, Platforms and Financial Advisory firms where she gained invaluable practical knowledge that enhances her ability to excel in our back-office operations at Affinity Private. With her proficient administration skills and plethora of experience, Kelli will contribute to Affinity Private’s ongoing efficiency and success.

Kelli has a Diploma of Financial Planning and when she is not working is a mum to Georgia & Campbell.

Elisha Oliver – Client Services

Elisha brings extensive experience to Affinity Private having worked in financial services since 2004.

Working alongside financial advisers as both a Portfolio Administrator and Para-planner has given her a breadth and depth of practical experience that has proven to be invaluable to the back-office operations of Affinity Private.

Elisha’s attention to detail is one of her best qualities and she takes complete ownership of every task and administers each request from beginning to end. Elisha has a Diploma of Financial Services and a Bachelor of Business with a Major in Management and Human Resources.

Corrine Spits – Client Services

Corrine has been working in financial services in a client services capacity since 2004.

She has worked with Financial Advisers, supporting them and providing exceptional customer service to clients. Her years of experience have given her invaluable practical knowledge that she brings to the back-office operations at Affinity Private.

Corrine prides herself on her efficient manner, quality customer service and attention to detail.