Strive for financial order to achieve inner calm

17/10/2019

Market Update – November 2019

20/11/2019Issue 10, October 2019

From the MD's Desk

By Rodney M. DeGabriele – Principal & Managing Director

Welcome to Affinity Insights!

We are always reviewing the way we deliver our services to ensure it maximises value and the chance of meeting our clients goals and objectives. As you would observe we are in an increasingly uncertain macro & geopolitical environment and given the significant wealth created over this cycle (last 10 years) we wanted to ensure that our investment service remains well positioned for the changing landscape.

We have had great success selecting active equity managers such as Magellan whose stock picking and portfolio management expertise have created enormous value for our clients. Over the long term however, it is the strategic asset allocation which drives the majority of returns and we have sought out Drummond Capital Partners, a specialist investment manager whom can assist us with asset allocation and also fund selection.

Affinity has a successful and sophisticated client base whom share a lot of similar traits and we have engaged Drummond to provide us with a bespoke solution that captures our investment philosophy, our client’s preferences as well as bringing their best ideas at both the asset class and fund level.

Key members of the Drummond team have joined the Affinity investment committee and will assist by providing the following services:

- Annual risk and return forecasts for all major asset classes

- Optimised strategic asset allocation for different risk profiles

- A list of best of breed fund managers for each asset class backed by their independent research

- Portfolio implementation and rebalancing to ensure timely execution of ideas

- Monthly and quarterly reporting to give our clients greater insights

- Regular market and fund research updates

As your trusted advisor we will then take these ideas and insights and implement them into your broader tailored strategic plan, customising as required to ensure the continuation of the personalised service you are accustomed to.

Our partnership with Drummond also gives us access to their scale and institutional pricing arrangements, the net result is that our clients will get the full benefit of these service enhancements without any additional investment costs.

We do hope you enjoy this issue of Affinity Insights, and we welcome any feedback or suggestions for future topics.

Global Market Volatility

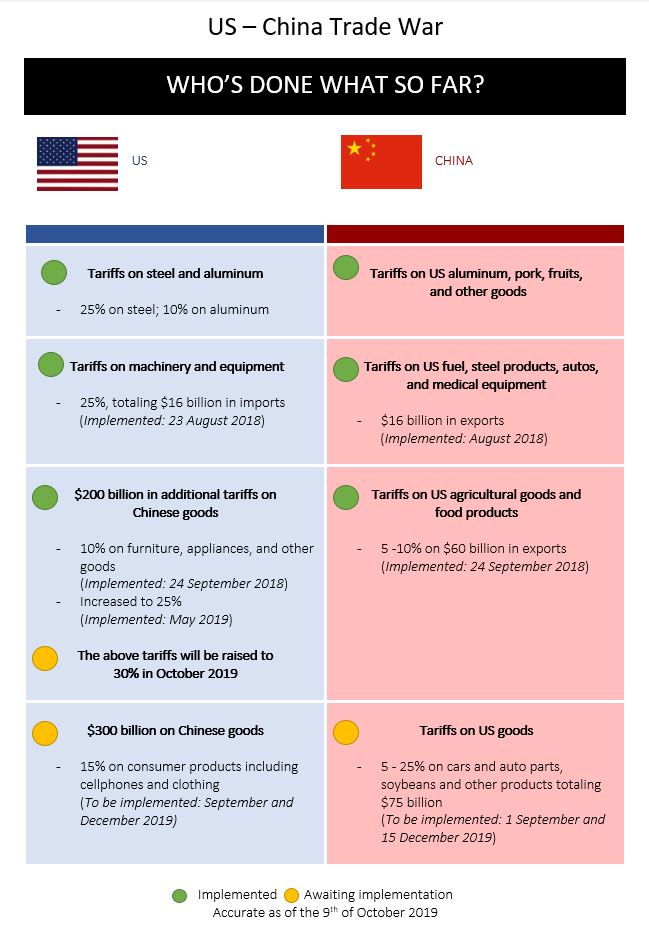

We are continuing to monitor global market activity and the inherent volatility due to the wide ranging geo-political uncertainty; namely the Trade War.

Referencing the latest 4-week VIX Index, we are continuing to maintain our HOLD position with cash, as our reasons back in August remain relevant. In addition to our post in August, history tells us that the month of October is also notoriously unstable. We will be in touch to discuss using term deposits as a short-term holding strategy.

Should you wish to discuss your portfolio, please speak directly to either Tony Vikram on 0421 344 238 or Rodney on 0488 993 175.

Trump, Tweets & Tariffs – Global Market Outlook

We would like to thank the clients who attended our most recent event in September, we hope that you found it interesting and informative.

We were pleased to recently hear a global market update from the co-founders of Drummond Capital Partners. The co-founders Nick Reddaway and Tom Schubert unpacked the issues surrounding the current geopolitical uncertainty, and what really matters for markets.

Nick and Tom addressed where we are in the global economic cycle, current valuations and the outlook for equities, housing and interest rates.

For those who missed this event in September, we will be Revisiting the Global Market Outlook on the 15th of November. Invites will be sent out in the following days.

Strive for financial order to achieve inner calm

By Catherine Robson

I have just returned from a holiday and, feeling inspired by happiness guru Gretchen Rubin’s recent book Outer Order Inner Calm, I tackled a dreaded job – sorting out the Tupperware cupboard.

After years of neglect, our family has taken to throwing plastic containers into this cupboard and quickly slamming the door shut before a cascade of plastic descends to the floor.

Once the job was complete, however, I felt an intoxicating lightness and energy.

The positive feelings were a gateway to address other nagging unresolved issues.

At this early stage of the new financial year, it is a perfect time to apply this approach to money matters.

Follow the link for some tips to get your financial house in order.

Chatham House Financial

Here at Affinity we have made a conscious decision to align ourselves with the best people in the finance industry, whether it be accountants, estate lawyers or international tax experts, to help our clients make informed decision across all of the financial aspects in their lives.

No exception to this, is our deliberate affiliation with the team at Chatham House Financial, who we know are one of the best in the finance brokering industry. Chatham House Financial understand our client’s complex needs and can help facilitate the process of taking out finance, whether to purchase a principal home, investment asset or commercial premise.

We have been working very closely with Chatham House Financial over the last 2 years and have seen our clients benefit from improved finance product options, resulting from not going directly to a financial institution, where only in-house products are on offer.

Working on behalf of our clients and not the banks, Jarrod Cahill and Jeremy Toeng, have time and time again proven themselves to be an excellent asset to our clients. Having a person on your side who can agitate the banks and understands the loan market, offers our clients the best chance of a great outcome.

Could Vietnam become the new China?

History hasn’t been kind to Vietnam; however, the future is looking bright for the developing country. Vietnam has already watched manufacturing begin to migrate from China, with GoerTek shifting its Apple Air Pods production and Google moving its Pixel smartphone production across the border. Japanese and South Korean foreign investment has seen Vietnam produce most of Samsung’s smartphones, helping drive Vietnam’s annual GDP growth rate to 7%.

Broadening the appeal in Vietnam is its large working age population, of their 95 million population, half are working age, and two thirds are younger than 35. Another large attraction to Vietnam is the cost, wages in Vietnam are about a third of those in China. With a long coastline and deep-water ports, geography is also on Vietnam’s side. Their infrastructure is beginning to improve, and access to internet has doubled in six years.

Still it is unknown how much Vietnam will benefit from the current US-China trade war. With a significant cost associated with shifting production across borders, many companies will choose to wait out the current tension. However, for companies looking to reduce their exposure in China, Vietnam appears to be a noticeable replacement.

Is there a storm brewing?

There are concerning unresolved global issues weighing on investors, and undoubtedly the general populations minds. With the 31st of October Brexit deal or no deal fast approaching, people are still in dark whether a resolution will be reached, the pending US-China trade war is a remaining conflict, with both countries at a standstill and Hong Kong’s protesters, have maintained momentum against powerful government forces.

The question is, could these global factors cause a market correction, or could they lead us toward long-term negative growth?

A correction can be defined as a fall of a stock or index of 10% or more, from its most recent peak. A correction is often short, lasting on average three to four months. While corrections can be scary, they present buying opportunities and adjust overvalued assets.

Recessions are generally identified by negative GDP growth for two successive calendar quarters, affecting aspects of the wider economy such as wage growth, employment and company revenue, often lasting between two to five years.

Hopefully the current global issues can begin to be resolved and put our minds at ease, before they have the potential to cause a lasting effect.