Market Update – March 2022

17/03/2022

How to get your children interested in money and finance

07/04/2022On 29 March 2022, the Government handed down the 2022-2023 Federal Budget. Although we know this is a pre-election Budget, the measures announced are very targeted and there is a clear focus on the cost of living, with inflation levels and cost of many goods rising.

This Budget recognises the significant level of Government debt from previous and forecasted budgetary deficits and the Government’s desire to also be seen as being fiscally responsible in the current economic environment.

Below we have outlined some of the Government’s proposals. Of course, it is always important to remember that at this point, the Budget night announcements are only statements of intended change and are not yet law.

Taxation measures

One of the major taxation measures in this year’s budget was the temporary reduction in fuel excise.

From 30 March 2022 until 28 September 2022 the Government will assist in reducing fuel prices by halving the excise and excise-equivalent customs duty rate that applies to petrol and diesel for a limited 6-month period. Excise taxes for other fuel and petroleum-based products, other than aviation fuel, will also be reduced by half. The current rate applied to petrol and diesel is 44.2 cents per litre, this reduction will bring the rate on petrol and diesel to 22.1 cents per litre, with the price faced by consumers expected to be reduced by a larger degree given GST will be levied on the lower excise rate. This measure aims to help individuals, families, and businesses with cost-of-living pressures which flow through to higher transport costs including the cost of goods and services.

At the end of the 6-month period, previous rates will apply, including indexation that would have occurred on those rates during the period.

The Australian Competition and Consumer Commission (ACCC) will monitor the price behaviour of retailers to ensure that the lower excise rate is fully passed on to Australians during the 6-month period.

Medicare Levy

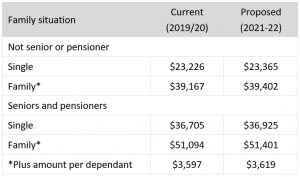

The Government is proposing to increase the Medicare levy thresholds for singles, families, seniors, and pensioners from 1 July 2021, as follows:

Business Support

Small business – skills and training boost:

Small businesses (with aggregated annual turnover of less than $50 million) will be able to deduct an additional 20 per cent of expenditure incurred on external training courses provided to their employees. The boost will apply to eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 until 30 June 2024. Some exclusions will apply, such as for in-house or on-the-job training and expenditure on external training courses for persons other than employees.

The boost for eligible expenditure incurred by 30 June 2022 will be claimed in tax returns for the following income year. The boost for eligible expenditure incurred between 1 July 2022 and 30 June 2024, will be included in the income year in which the expenditure is incurred.

Small business – technology investment boost:

Small businesses (with aggregated annual turnover of less than $50 million) will be able to deduct an additional 20 per cent of the cost incurred on business expenses and depreciating assets that support their digital adoption, such as portable payment devices, cyber security systems or subscriptions to cloud-based services. The boost will apply to eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 until 30 June 2023. An annual cap will apply in each qualifying income year so that expenditure up to $100,000 will be eligible for the boost.

The boost for eligible expenditure incurred by 30 June 2022 will be claimed in tax returns for the following income year. The boost for eligible expenditure incurred between 1 July 2022 and 30 June 2023 will be included in the income year in which the expenditure is incurred.

Superannuation Measures

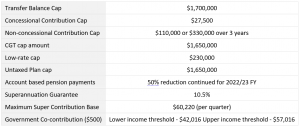

Superannuation Thresholds from 1 July 2022 to 30 June 2023 (changes only):

Superannuation Guarantee

The Superannuation Guarantee is to increase to 10.5% for all eligible employees effective from 1 July 2022. The rate will increase by 0.5% each year until it reaches 12% on 1 July 2025. The incremental increases are outlined in the table below:

Pension Payments

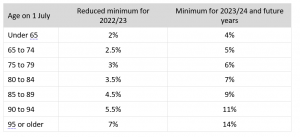

In support of retires, the Government has announced the extension of the temporary reduction in superannuation minimum drawdown rates. The 50% reduction applies to clients who have commenced an account-based pension and similar products for a further year to 30 June 2023. This measure will also apply to clients who are in pension phase within self-managed superannuation funds.

The minimum drawdown requirements determine the minimum amount that a retiree must draw from their superannuation each year in order to qualify for tax concessions. Given ongoing volatility, this change will reduce the need for retirees to sell assets in order to satisfy the minimum drawdown requirements. There is no change to the maximum drawdown limit.

The below table summarises the reduced annual minimum pension payment factors for account-based pensions (including transition to retirement pensions).

Under the temporary drawdown reduction measures, annual payments from term allocated pensions can be reduced to 45%. Usually, annual payments from term allocated pensions can be varied between 90% and 110% of the calculated annual payment.

Social Security Measures

In support of easing the cost of living, from 1 July 2022, the Government will reduce the Pharmaceutical Benefits Scheme (PBS) Safety Net thresholds from $1,542.10 to $1,457.10 for general patients and from $326.40 to $244,80 for concessional patients.

As a result of these changes, concessional patients will reach their Safety Net sooner each year. Once the PBS Safety Net is reached, concessional patients receive their PBS medicines at no cost for the rest of the calendar year and general patients receive their PBS medicines at the concessional co-payment rate which is currently $6.80 per prescription.

Women’s Measures

As of February 2022, the Government has stated that women’s workforce participation has increased to 62.4%, the highest participation rate on record. In addition, the gender pay gap has narrowed to 13.8%. However, the Government has conceded that more needs to be done to improve the respect for women, achieve gender equality and increase choice and flexibility for women and families.

In this year’s Federal Budget, the Government has committed $2.1 billion to supporting women and girls with a continued focus on women’s safety, women’s economic security and leadership, and women’s health and wellbeing.

Women’s safety:

The Government has announced they will invest a further $1.3 billion to drive change under the National Plan to End Violence against Women and Children – the next National Plan. The next National Plan, currently being finalised to commence in mid-2022, sets out the Government’s commitment to ending violence against women and children and includes the four pillars of prevention, early intervention, response, and recovery.

Women’s economic security:

The Government has committed $482 million into measures that will provide greater flexibility and choice about how to manage work and care, and support women into more diverse industries, jobs of the future and leadership positions. The Government has announced the provision of up to 20 weeks of Enhanced Paid Parental Leave for families where Dad and Partner Pay can be rolled into Parental Leave Pay to create a single scheme of up to 20 weeks, fully flexible and shareable scheme for eligible working parents as they see fit.

Paid Parental Leave can also be taken any time within two years of the birth or adoption of their child. The income test will also be broadened to have an additional household income threshold of $350,000. Eligible single parents can also access an additional two weeks (for a total of 20 weeks) of Paid Parental Leave under the scheme.

The change seeks to create greater flexibility between couples as to how they share care and work responsibilities for newborn or adopted children.

To drive progress towards gender equality in Australian workplaces, the Government has committed $18.5 million over four years from 1 July 2022 for the Workplace Gender Equality Agency (WGEA) to ensure WGEA is equipped to implement the recommendations from the review of the Workplace Gender Equality Act.

The Government has announced several initiatives to support women to take up opportunities in underrepresented sectors and higher paid trades and occupations. These initiatives include:

- Boosting the number of women in trades

- Encouraging women into the manufacturing industry

- Supporting more women into digitally skilled roles

- Expanding the Future Female Entrepreneurs program, and

- Consulting on how best to ensure redundancy payments more fairly reflect working hours over the course of a person’s employment.

Women’s health and wellbeing:

In this year’s Federal Budget, the Government has announced several measures to support the health issues that most affect women and girls throughout their lives. These include funding for:

- Genetic testing in pregnancy

- Improving treatment, management, and diagnosis of endometriosis

- Changes to the Medicare Benefits schedule to support women’s health

- Community led initiatives and organisations, and

- Initiatives that prevent chronic illness and improve health and wellbeing among Australian women and girls.

The information contained in this article is current as at 31/03/2022. Any advice or information contained in this report is limited to General Advice for Wholesale clients only.

The information, opinions, estimates and forecasts contained are current at the time of this document and are subject to change without prior notification. This information is not considered a recommendation to purchase, sell or hold any financial product. The information in this document does not take account of your objectives, financial situation or needs. Before acting on this information recipients should consider whether it is appropriate to their situation. We recommend obtaining personal financial, legal and taxation advice before making any financial investment decision. To the extent permitted by law, Affinity Private Advisors does not accept responsibility for errors or misstatements of any nature, irrespective of how these may arise, nor will it be liable for any loss or damage suffered as a result of any reliance on the information included in this document. Past performance is not a reliable indicator of future performance.

This report is based on information obtained from sources believed to be reliable, we do not make any representation or warranty that it is accurate, complete or up to date. Any opinions contained herein are reasonably held at the time of completion and are subject to change without notice.

.