In a world of fake news, how to understand what is really happening

13/11/2018

There’s never been a better time to be an investor

13/12/2018October Market Performance

The Pulse

- US economic growth moderated in the September quarter but is underpinned by strong consumer spending growth.

- The IMF recently downgraded its forecast for global economic growth, partly reflecting the US-China trade war.

- In Australia, business conditions remain relatively robust while labour market conditions continue to show signs of underlying strength.

- Chinese GDP grew by 6.5% year-on-year in the September quarter, below the expected 6.6% and down from the June quarter’s growth of 6.7%.

- Incoming European data was weaker than expected but consistent with broad-based growth and growing inflation expectations.

Global economies

Global economic growth remains relatively robust, especially in the US, but an adjustment in inflation expectations along with concerns about peaking corporate earnings growth resulted in a dramatic selloff in equities in October, similar to that seen in February this year. The IMF recently downgraded its forecast for global economic growth, partly reflecting the US-China trade war, with global GDP growth for 2018 and 2019 revised down from 3.9% to 3.7%.

US

US September quarter GDP grew by an annualised 3.5% according to October’s advance estimate, beating expectations for growth of 3.4% and boosted by consumer spending growth of 4.0%—the fastest rate since the December quarter of 2014. While growth moderated from the annualised 4.2% rate recorded in the June quarter, the continuing strength of consumer spending is promising. Concerns remain however about the sustainability of recent growth, with fixed investment falling slightly during the quarter despite the implementation of the Trump administration’s tax cuts earlier in the year. The non-farm payrolls release showed 250,000 jobs were added over October, breezing past the expected 190,000. The unemployment rate was steady at 3.7% and remains the lowest since December 1969, while average hourly earnings rose by 5 cents to $27.30 and have risen 3.1% over the past 12 months, representing the fastest pace since 2009. While President Trump’s comments that the Fed had “gone crazy” and was “out of control” certainly did not help, uncertainty regarding the so-called ‘neutral’ Fed funds rate may have been a factor in the sharp rise in yields seen through October. Despite some warranted scepticism of political polling, the baseline consensus for the mid-term elections proved correct, with the Democrats winning control of the House and Republicans holding the Senate. The result lowers the chances of a large fiscal stimulus, while Trump will also need the blessing of House Democrats for any new trade deals.

Europe

Euro area GDP grew 0.2% in the September quarter according to October’s initial estimate, missing the expected 0.4% growth. Markets did not appear too fazed by the result, with temporary factors such as disruptions in car production from new car emissions testing procedures impacting growth, and lower oil prices through October seen as positives for consumers going forward. Of concern, however, is the data for Italy, which showed the national economy stagnating in the September quarter, while the PMI points to negative growth early in the December quarter. The Italian government intends to stick to its election promises, including its controversial basic income policy and tax cuts. The government is aiming for a budget deficit of 2.4% of GDP, which would represent a significant fiscal expansion from the previous government’s 1.6% target, risking a confrontation with the European Commission and unnerving financial markets. Euro area annual inflation is expected to be 2.2% for October, up from 2.1% in September, while core inflation is expected to rise from 0.9% to 1.1%. The ECB held its key rates in October, with President Draghi acknowledging that incoming data was weaker than expected but consistent with broad-based growth and growing inflation expectations.

China

Chinese GDP grew by 6.5% year-on-year in the September quarter, below the expected 6.6% and down from the June quarter’s growth of 6.7%. The official manufacturing PMI dropped from 50.8 to 50.2 while the Caixin PMI was for all intents and purposes flat, rising from 50.0 to 50.1. Authorities have in recent months unveiled measures to reduce financing costs, cut taxes and fast-track infrastructure projects, although such modest stimulus may take time to have an impact. The People’s Bank of China has cut reserve requirements for lenders four times this year—a total reduction of 2.50%—with the latest cut taking effect on 15 October, injecting more liquidity to stimulate bank lending. Shibor rates have declined and the 6.0%-plus decline in the yuan may also absorb some of the downside pressure. The impact of tariffs on growth is difficult to determine but the IMF recently downgraded its projection for Chinese GDP growth in 2019 from 6.4% to 6.2%, citing trade as a key issue. Indeed, trade data for September showed higher than expected growth in Chinese exports, up 14.5% year-on-year as producers frontloaded exports ahead of the tariffs. Scenario analysis by the IMF indicates that a full-blown trade war between the US and China, including an extension of tariffs to automobiles and commensurate retaliatory measures, would knock 1.6 percentage points off China’s GDP growth.

Asia region

October business survey data pointed to a rebound in economic activity during the month, with the manufacturing sector PMI rising from 52.5 to 52.9, underpinned by sharper output growth, possibly covering shortfalls in September due to bad weather. Prices data also pointed to a sharper rate of input cost inflation, prompting firms to raise output prices by the greatest extent for ten years. In the services sector, output was supported by the largest improvement in demand conditions in over five years. So far, the December quarter is off to a good start, while growth through the September quarter is likely weaker than that seen through the first half of 2018, with economic activity likely contracting by around 0.9% in the final month according to the Japan Center for Economic Research. Household spending fell in September by 1.6% year-on-year and remains constrained by low wage growth. In India, the growth outlook remains broadly positive, supported by robust consumer spending and a pickup in investment, but is constrained by higher oil prices, a sharp depreciation in the rupee, and tightening monetary policy. The Reserve Bank of India is expected to continue its tightening path as tension between Prime Minister Modi and Governor Patel escalates, while the RBI seeks to take action to address liquidity concerns in the non-bank finance sector.

Australia

Despite the risk of a material slowdown in the Chinese economy, evidence of a decline in house prices, and global trade concerns, business conditions remain relatively robust while labour market conditions continue to show signs of underlying strength. At its November meeting the RBA lifted its forecast for economic growth in 2018 and 2019 slightly to 3.5%, with growth then set to slow in 2020 due to reduced exports of raw materials. Minutes from the September RBA meeting signalled a heightened risk in the housing market, raising the possibility that banks could tighten lending conditions further in light of the Royal Commission into Financial Services report. Employment continued to grow through September, with 20,300 full-time jobs added, offset by a fall in part-time jobs of 14,700. Recent seasonally adjusted figures have indicated a possible slowing in momentum, but trend employment growth shows the labour market continues to tighten. The unemployment rate fell 0.3 points to 5.0%—the lowest level since April 2012—helped by a fall in the participation rate. The AIG Manufacturing Index fell 0.7 points to 58.3 in October, reflecting continued overall strength in manufacturing activity. Respondents in the large machinery and equipment sector noted rising input costs due to the lower Australian dollar and lower sales in drought-affected areas.

Equity Markets

- The S&P/ASX 200 Index fell 6.1% through October with defensive sectors outperforming but still negative.

- The US S&P 500 Index fell 6.8% in US dollar terms, and in price terms the index surrendered all of its year-to-date gains in just three weeks.

- Europe’s broad STOXX Europe 600 Index lost 5.3% in October, with the German DAX 30 Index falling 6.5% and the French CAC 40 Index down 7.2%.

- In Asia, Japan’s Nikkei 225 Index fell 9.0% and China’s CSI 300 Index fell 8.3%.

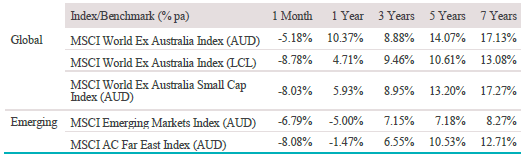

- Global developed market shares fell 5.2% in AUD terms while emerging market shares continued to slide, falling 6.8%.

Australian Equities

The S&P/ASX 200 Index returned -6.1% through October as local markets reacted to selling on Wall Street and growth shares came under pressure. Sectors that previously enjoyed a relatively robust earnings trajectory in recent months, such as Health Care and Information Technology , were hit hard, falling 7.0% and 11.2% respectively as investors backed away from elevated valuations. Returns for ‘bond proxy’ sectors such as Utilities (-4.0%) and A-REITs (-3.1%) were the least negative during the month but continue to be buffeted by moves in the US bond market, which has seen yields push higher as investors raise their inflation expectations in response to the strength and duration of the current US economic cycle. Some of Australia’s own growth darlings came under pressure, including fintech player Afterpay Touch (-30.4%) and global logistics software provider WiseTech (-27.3%), but both were still trading at around 50x FY20 earnings by month-end. Within the Energy sector (-10.5%), Worley Parsons (-24.7%) saw the biggest drop, with investors cautious about the price paid for its $4.6 billion acquisition of Texas-based Jacobs Engineering’s energy, chemicals and resources business. Materials (-5.2%) saw mixed results, with gold miner Saracen Mineral Holdings (+31.4%) posting big gains on the back of record production, while BlueScope Steel (-15.4%) extended losses despite Australia’s exemption from US steel tariffs.

* Total returns based on GICS sector classification

Big movers this month

Going up:

n/a

Going down:

Information Technology -11.2%

Energy -10.5%

Consumer Discretionary -8.0%

Global equities

In the US, the market rally gave way to a rolling bear market in October, with debate raging about whether the selloff was predominately technical or driven by fundamentals. Global shares, measured by the MSCI World Ex Australia Index, returned -5.2% in Australian dollar terms, while small cap shares fared even worse, returning -8.0%. While systematic flows may have exacerbated the drawdown, there are signs of slowing earnings momentum in the US and companies missing EBIT margin estimates for 2019, while liquidity and Fed tightening remain overarching concerns. The S&P 500 Index returned -6.8% in US dollar terms, and in price terms the index surrendered all of its year-to-date gains in just three weeks. Losses were concentrated in the areas of the market where fund managers have relatively higher levels of exposure, including Information Technology (-8.1%), Consumer Discretionary (-11.3%), Energy (-11.3%) and Industrials (-10.9%). The STOXX Europe 600 Index lost 5.3% in October with the largest falls coming from Industrial Goods and Services (-9.3%), Technology (-8.7%), and Banks (-9.3%). Chinese equities and the yuan remained under pressure over the past month as investors fretted over the ongoing slowdown in growth and the potential negative impact from the escalating trade war with the US.

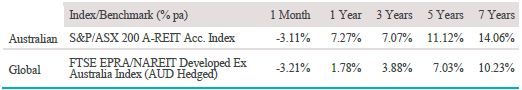

Property

The S&P/ASX 200 A-REIT Index returned -3.1% in October but was the top performing sector, with solid gains from Shopping Centres Australasia (+7.1%) and BWP Trust (+3.6%). Australia remains reasonably attractive in terms of commercial property yield spreads to bonds (around 3.0% compared to the long-term average of 3.5%) and the fall in the Australian dollar through 2018 has made property cheaper to foreign investors. Corporate activity in the sector has also picked up recently, with Oxford Properties Group winning the race to take over Investa Office Fund (+0.5%) with a $3.4 billion cash offer. The residential property market is reporting signs of reduced auction clearance rates and easing prices, particularly at the top end of secondary market transactions, and the high-rise apartment market is showing some signs of retreat with developers delaying projects. The residential sector still faces some uncertainty as to the impact of recent bank lending curbs, lifts in foreign investor charges, plus the speed of interest rates increases. US REITs continued their slide in October, although results were mixed. The Bloomberg US REIT Index was down 2.8%, with falls in Hotels (-9.9%) and Offices (-5.2%) while Single Tenant property (+3.6%) and Storage REITs (+2.1%) led the gains.

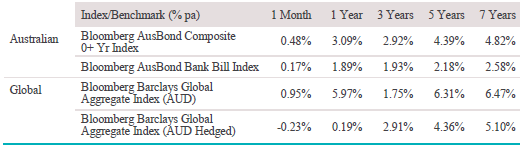

Fixed interest

Global bonds, measured by the Barclays Global Aggregate Index, returned 1.0% in October in AUD terms and -0.2% in AUD hedged terms. October was dominated by the sharp rise in US bond yields and the accompanying downturn in global equity markets, with the US 10-year yield pushing to a high of 3.26%, while the S&P 500 suffered a 9.9% drop from its record high in September to its October low. Ongoing strength in the US economy and a readjustment in inflation expectations was the obvious culprit, although loose guidance from the US Fed may also have been a contributing factor. The market lifted its expectation for the Fed funds rate, factoring in a December move and two further hikes in 2019 to 2.875% but with a low probability of further action. Yields eased through the end of October and early November as the market came under pressure from record volumes of longer-dated US government debt supply, which saw the 10-year yield slip to 3.18%, while the US Dollar index fell below 96. Australian bonds returned 0.5% in October and it was rocky ride for the Australian 10-year yield as well, which hit a high of 2.78% in October before falling to a low of 2.57% late in the month, only to shoot back above 2.75% by the second week of November.

Australian dollar (AUD)

The Australian dollar fell 2.1% in October to US $0.7072 and is down 7.7% over the past 12 months. The currency is close to levels reached during the 2015-16 Chinese deflation scare, although somewhat at odds with the more sombre forecasts, bulk commodity prices have remained relatively steady this year. Emerging market currencies staged a recovery in October, with the Brazilian real up 9.4% against the US dollar and the Turkish lira rising 8.8%.

The information contained in this Market Update is current as at 12/11/2018 and is prepared by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421445 on behalf of National Australia Bank and its subsidiaries.

Any advice in this Market Update has been prepared without taking account of your objectives, financial situation or needs. Because of this you should, before acting on any advice, consider whether it is appropriate to your objectives, financial situation and needs.

Past performance is not a reliable indicator of future performance. Before acquiring a financial product, you should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product.