Market Update – February 2022

14/02/2022

Market Update – February 2022 – Ukraine & Russia

24/02/2022In its 2020 Budget Digital Business Plan, the Australian government announced the full implementation of the Modernising Business Registers (MBR) program. The program is designed to both establish the new Australian Business Registry Services (ABRS), and enhance how businesses register and manage their information with the government.

Although the ABRS rolls out progressively between 2021 and 2024, one of the immediate changes is that business directors must obtain a director identification number.

Director identification number definition

A director identification number is a unique number you as a director apply for once and keep forever. It’s designed to prevent the false or fraudulent use of your identity.

The number is 15 digits long and is allocated to any director – or someone who plans to become a director – who has verified their identity with the ABRS. All Australian director identification numbers start with the digits 036 (Australia’s country code under International Standard ISO 3166) and end with an 11-digit number plus one digit designed for error detection.

This ID number is yours forever, even if you change companies, stop being a director, change your name or move overseas.

Why do you need a director ID

Verifying your identity with the ABRS helps prevent fraudulent or false IDs from being used, which makes it easier for regulators to trace directors’ relationships with companies over time and identify and eliminate unlawful director activity. It safeguards your identity and reduces the chance of identity fraud.

Additionally, various groups including employees, creditors and shareholders are entitled to know the names of a company’s directors.

Who must obtain a director ID

Any eligible officer of a company, including people who are appointed as a director or an alternate director of a company, must obtain a director ID. This includes people who are a director of a company, a registered Australian body, a registered foreign company, an Aboriginal and Torres Strait Islander corporation, or a corporate trustee.

Under the Corporations Act, a director must be at least 18 years old and cannot be disqualified from managing corporations, unless ASIC or the Court has given permission. Under the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act), a director must be at least 18 years old, a member of the Aboriginal and Torres Strait Islander corporation and an Aboriginal and Torres Strait Islander person, and not disqualified from managing a corporation, unless permitted by the Registrar.

Finally, some people do not need an ID, such as are those who are a company secretary but not a director; a company’s external administrator; running a business as a sole trader or partnership; or have “director” in the job title, but were not appointed officially as a director under the Corporations Act or the CATSI Act.

Find out more on who needs to apply and when at the Australian Business Registry Services site.

Applying for a director ID

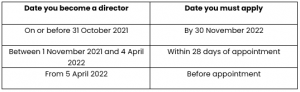

Starting from November 2021 you must apply for a director ID if you meet the director criteria outlined above. Your deadline depends on the date you became a director. If you become a director under the Corporations Act, then:

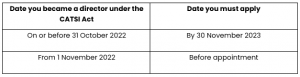

If you become a director under the CATSI Act, then:

To apply:

- Set up your myGovID

- Gather your documents, including your tax file number (TFN), your residential address and ID verification

- Login to ABRS and apply

It is free to apply for your director identification number, but you must apply for your own number and verify your identity. Unfortunately, Affinity Private Advisors are unable to apply for this on your behalf. Please get in contact with us if you need guidance.

For more information on the director identification number, visit the Australian Government Australian Taxation Office on Modernising Business Registers or the Australian Business Registry Services site with a full overview of the Director Identification Number process.

The information contained in this article is current as at 24/02/2022. Any advice or information contained in this report is limited to General Advice for Wholesale clients only.

The information, opinions, estimates and forecasts contained are current at the time of this document and are subject to change without prior notification. This information is not considered a recommendation to purchase, sell or hold any financial product. The information in this document does not take account of your objectives, financial situation or needs. Before acting on this information recipients should consider whether it is appropriate to their situation. We recommend obtaining personal financial, legal and taxation advice before making any financial investment decision. To the extent permitted by law, Affinity Private Advisors does not accept responsibility for errors or misstatements of any nature, irrespective of how these may arise, nor will it be liable for any loss or damage suffered as a result of any reliance on the information included in this document. Past performance is not a reliable indicator of future performance.

This report is based on information obtained from sources believed to be reliable, we do not make any representation or warranty that it is accurate, complete or up to date. Any opinions contained herein are reasonably held at the time of completion and are subject to change without notice.

.