Market Update – October 2024

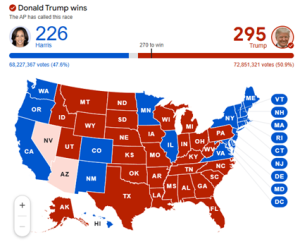

22/10/2024Key Points: Despite concerns there could be long delays in vote counting or allegations of electoral fraud, the 2024 US election passed very smoothly. Trump has won convincingly, taking both the popular vote and the electoral college. Republicans will hold a majority in the Senate, but this will be slim enough that Democrats have a reasonable chance at stymieing proposed changes in legislation. The House remains undecided. Source: AP Assuming the Republicans take the House (and can therefore, enact their agenda to the greatest degree,) we think the equity market impact will be mixed. As we highlighted in our September 2024 Market Update, generally there is a very wide gap between the policy proposals of a campaign platform and what is legislated. Even with a complete Republican control of the Senate and House in 2016, President Trump was unable to fully enact his agenda. Congresspeople in the US are not obligated to tow the party line like in Australia and they often vote against their party platforms. Regardless, we can summarise the platform and categorise it into pro and anti-market items: Source: Drummond Capital Partners Overall, we see the policy platform (if fully implemented) roughly neutral for equities, but bad for bonds. Importantly, there is a feedback loop between bonds and equities which needs to be considered. If an increase in yields is too large or too fast like 2022, equity markets will react negatively. This is something that we will be watching carefully for. Equity markets have so far reacted positively to the election result, likely expecting that it will be easier for Trump to legislate tax cuts and deregulation through a Republican controlled Congress than enacting higher tariffs (which will upset much of the business community). However, if he walks away from a tax cut agenda equity markets could easily swing the other way. Portfolio positioning Growth asset exposure in our portfolios remains neutral with a large core position in US equities which have risen strongly following the result. The portfolios also remain strongly underweight government bonds. President Trump won’t be inaugurated until 20 January next year, following which the work will begin to make legislative changes. Nothing happens quickly in Government, so there should be time to listen to policy proposals and position the portfolios accordingly if changes are necessary. This is prepared by Drummond Capital Partners (Drummond) ABN 15 622 660 182, AFSL 534213. It is exclusively for use for Drummond clients and should not be relied on for any other person. Any advice or information contained in this report is limited to General Advice for Wholesale clients only. The information, opinions, estimates and forecasts contained are current at the time of this document and are subject to change without prior notification. This information is not considered a recommendation to purchase, sell or hold any financial product. The information in this document does not take account of your objectives, financial situation or needs. Before acting on this information recipients should consider whether it is appropriate to their situation. We recommend obtaining personal financial, legal and taxation advice before making any financial investment decision. To the extent permitted by law, Drummond does not accept responsibility for errors or misstatement of any nature, irrespective of how these may arise, nor will it be liable for any loss or damage suffered as a result of any reliance on the information included in this document. Past performance is not a reliable indicator of future performance. This report is based on information obtained from sources believed to be reliable, we do not make any representation or warranty that is accurate, complete or up to date. Any opinions contained herein are reasonably held at the time of completion and are subject to change without notice. .A US Election Update