Federal Budget 2021

13/05/2021

Rags to Riches to Rags

07/06/2021Issue 16, May 2021

From the MDs' Desk

Welcome to our 16th edition of Affinity Insights.

Well done, Australia, our hard work has paid off. Almost all restrictions and lockdown rules have been eased. Fourteen months ago, amid our first lockdown we only had four reasons to leave our homes and only for one hour a day. Fast forward to today, Australia compared to the rest of the world has achieved the unimaginable. Our restaurants are bustling, the comedy festival is in full swing, theatre and shows are returning, we can travel interstate and the MCG recorded the biggest attendance at a global sporting event since the start of the COVID-19 pandemic.

We hosted the February market update webinar with Drummond Capital Partners and received great feedback. Thank you to all those who attended. We endeavour to host more insightful events in the near future both online and in person.

We do hope you enjoy this issue of Affinity Insights and we welcome any feedback or suggestions for future topics.

From Rodney M. DeGabriele and Tony Vikram

Federal Budget 2021

The budget position has improved dramatically from the forecasts delivered in October 2020. The deficit for 2020-21 is now expected to be $161 billion, down from $213.7 billion. This reduction is largely due to a much stronger rebound in employment. Revenue is also receiving a boost from strong economic recoveries from our trade partners and higher than expected resource prices.

Recent remarks from the Treasurer Josh Frydenberg, have made it clear that there are still downside risks to the economy, and he expects the Government to continue providing a significant amount of support.

The unemployment rate is expected to fall below 5% by late 2022 and reach 4.75% by 2023. Having said that, the Government is still conscious of the impact of COVID-19 and is investing $1.9b on a vaccination strategy and $1.5b to extend the range of COVID-19 health responses.

To continue reading, please click here.

Alison Warner

We are delighted to announce that Alison Warner will be joining Rodney DeGabriele and Tony Vikram in an advisory capacity commencing 1 July 2021.

Alison comes with a wealth of experience, working in the financial services industry for over 15 years.

This time, four years ago, Alison became a part of the Affinity team and has since proven herself to be integral to our clients and business. Alison’s commitment and dedication has been nothing shy of excellent and will continue to support existing relationships within our practice.

Congratulations Alison! We are thrilled to be sharing this journey with you.

Beware of scams during tax time

Tax time is a prime time for cybercriminals trying to get their hands on your money and personal details. We have compiled a list of simple measures you can do to apply good cyber security practices and avoid tax time scams.

Most people expect some form of interaction with the Australian Taxation Office (ATO) during tax time, and scammers take advantage of this by pretending to be tax agents, law enforcement officers, the ATO and from myGov to try and steal personal and financial information from unsuspecting people.

Your personal information is valuable so it is important to stop and think before sharing it with anyone, no matter how convincing the person or message may sound.

- Always log into myGov to check your tax messages – do not click on any links in emails or text messages

- Accountant – if your tax affairs are managed by an accountant, always liaise with them before acting on any messages or correspondence

- Keep your personal information private – the ATO will never ask you to provide any personal identifying information in order to receive a refund

- Be smart with social media – manage your privacy settings and do not share your TFN on social media

- Help others be cyber safe – report suspicious emails claiming to be from the ATO by forwarding the entire email to ReportEmailFraud@ato.gov.au and then delete the email.

Market Update - Sunset for REITS & Infrastructure?

In this update, we dive into the real estate and infrastructure (RE&I) asset classes as a prelude to the mid-year Strategic Asset Allocation Review. Both were beat up in the Covid drawdown and remain underwater. Does their poor performance reflect structural impairment in a post Covid world or a decent buying opportunity relative to other listed equity markets? To make this determination, we assess the fundamental drivers of the longer term returns of RE&I and think about whether some of the underlying companies are holding assets which have been stranded by either the acceleration of long term thematics or due to climate change policy.

Click here to continue reading

Generational Wealth

“Generation wealth” is wealth that is passed down from one generation to the next. You may also hear this called family wealth or legacy wealth. This wealth can come in many forms such as real estate assets, stock market investments, or a financial education to carry forward into the future.

Whether you have children, grandchildren, nieces, or nephews; or decide to leave part of your legacy to a charity or foundation, you may start to think about how their financial futures will play out. Imagine how differently things could turn out if you take the time to educate them on personal finance and set up vehicles to add security to their financial future now.

To continue reading, please click here.

Affinity Private Advisors in the media

Rodney recently contributed to two articles – Money & Life magazine: sharing his insights in become a self-licenced practice and the benefits it brings to the business and our clients; and the Australian Financial Review: sharing his knowledge on the recent super changes and how there will be opportunities to enjoy more tax-free retirement income.

To read either article, please click on the links below

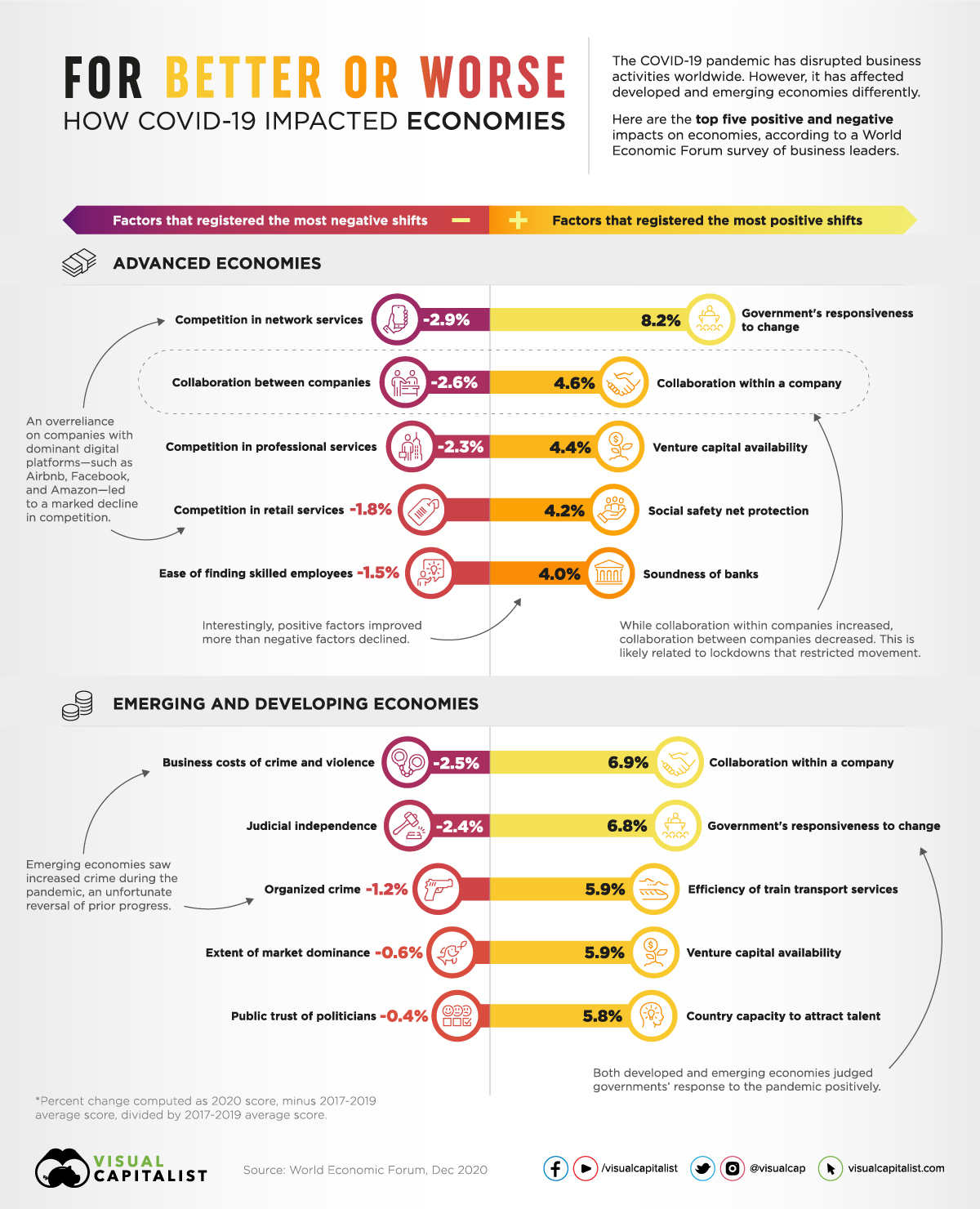

How Covid-19 impacted economies

Bitcoin - The crypto craze

Bitcoin has been a global hot topic over the past couple of years. More recently making headlines for prices surging above $60,000 USD. While it is fairly easy to describe what bitcoin is not, it is much harder to describe what bitcoin actually is. In this summary we will provide some information to help you assess the risks and returns of this new craze.

Bitcoin is not a currency.

- A currency serves 3 functions – a store value, a medium of exchange and a standard of value. Bitcoin barely meets any of these 3 criterias and is much too volatile to be considered a standard of value. As for a medium of exchange, to purchase bitcoin, a transaction can cost anywhere between $10-12USD which is far too expensive.

Bitcoin is a scarcity asset.

- There is a finite amount of bitcoin available. As at today, roughly 18.5M of the possible 21M bitcoin has been mined. Assuming that roughly 900 new bitcoins are mined each day, then by 2028 or 2029 the supply of bitcoin will be frozen at the intended 21mn units. This has been likened to a perpetual zero-coupon bond whose value cannot be destroyed by increased government issuance. But why would someone want to own a zero-coupon bond?

Bitcoin is the new tax haven

- Tax havens were targeted in 2008 during the crackdown on “hidden money”. The wealthy are always looking for ways to legally and sometimes illegally, avoid paying taxes. High end real-estate, luxury cars and off-shore accounts are examples of ways used by some. The birth of bitcoin come the desire, or the need for some people to hide wealth from governments. As many countries are still debating and coming up with legislation on how to deal with bitcoin, it is currently seen as an unregulated asset.

Bitcoin’s energy consumption

- If Bitcoin were a country, it would be in the 30 biggest electricity consumers in the world. To mine bitcoin takes a staggering amount of power and electricity consumption. Cryptocurrency mining is painstaking, costly, and only sporadically rewarding. To get a sense of just how much computing power is involved, when Bitcoin launched in 2009 the initial difficulty level was one. As of Nov. 2019, it is more than 13 trillion.

Conclusion

- Bitcoin has created $1TR USD value in a very short time. Without knowing what purpose bitcoin serves, investors should not be contemplating its ownership

Reference: Financial Manias: The Crypto Craze, Louis-Vincent Gave

Domestic travel opportunities

With international boarders remaining closed for the foreseeable future, many Australians are looking at opportunities to travel domestically as all states have removed their strict boarder restrictions.

Asia, Europe or Central America was always so enticing when deciding on the next travel destination that we sometimes forget the picturesque landscape we have right on our doorstep. Take advantage of the current airline deals with flexible booking policies to any one of these destinations –

- Far North Queensland – Great Barrier Reef and the Daintree Rainforest

- Northern Territory – Uluru, Kakadu National Park

- South Australia – Barossa Valley

- New South Wales – Byron Bay, Southern Highlands

- Western Australia – Rottnest Island, Exmouth

- Whitsunday Island

If being on an aircraft is still not for you, here are a list of local destinations to explore –

Victoria

- Mornington Peninsula

- Yarra Valley

- King Valley

- French Island

- Bright

New South Wales

- The Hunter Valley

- Byron Bay

- The Sapphire Coast

- Port Stephens

- Coffs Harbour

Western Australia

- Margaret River

- Broome

- Pinnacles & Cervantes

- Fremantle

- Swan Valley

Queensland

- Noosa Heads

- Springbrook National Park

- Moreton Island

- North Stradbroke Island

- Montville & Maleny