Market Update – March 2021

15/03/2021

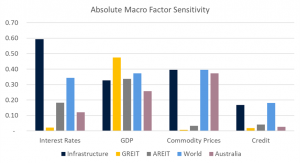

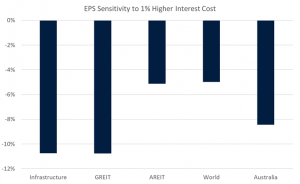

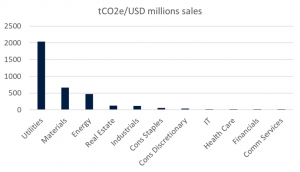

Generational Wealth

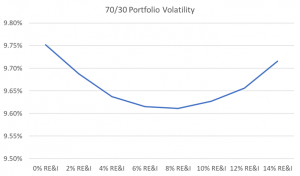

10/05/2021 In this update, we dive into the real estate and infrastructure (RE&I) asset classes as a prelude to the mid-year Strategic Asset Allocation Review. Both were beat up in the Covid drawdown and remain underwater. Does their poor performance reflect structural impairment in a post Covid world or a decent buying opportunity relative to other listed equity markets? To make this determination, we assess the fundamental drivers of the longer term returns of RE&I and think about whether some of the underlying companies are holding assets which have been stranded by either the acceleration of long term thematics or due to climate change policy. Return Drivers Why are RE&I considered asset classes in their own right? They are composed of equities, and we don’t separate out other equity sectors as a separate asset class. The logic behind the decision relies on the characteristics of the companies held in the sector being sufficiently different to the rest of the listed equities universe. For infrastructure, the case can be made that the companies tend to be monopolies (not subject to competition) and as a result tend to have regulated cash flows. This, in theory, should make their earnings growth fairly predictable over very long periods of time. For real estate, the differentiating factor is the ownership of land (the supply of which is fixed in prime areas) and the generating of income from renting and developing that land. This is notionally different from companies which manufacture and/or sell products and services. Often, when talking about RE&I, investment managers speak about their potential inflation hedging characteristics. These assets often have inflation ratchets specifically built into their regulated cash flows and leases. Almost every road, tunnel or bridge operated by Transurban has a periodic increase linked to a consumer price index (CPI). However, we think this is an oversimplification of the linkages. Most companies sell goods and services which are included in some form in CPI baskets. If food inflation is rising, so are the revenues of Coles and Woolworths. Thus, while there may not be explicit linkages, the revenue growth of the broad market as a whole probably looks pretty close to something like inflation plus economic growth over long time periods. Indeed, that is how we model very long-term earnings growth for major economies (with some other considerations of course). Because of these traits, we can make some hypotheses about how these asset classes should operate when compared with overall listed equities in different economic environments. Given monopolistic, long contracted, predictable earnings, we would expect sensitivity to interest rates to be higher than the broader market. For infrastructure in particular, we would expect sensitivity to economic growth to be lower than the market. However, our modelling suggests mixed evidence in practice. Below, we show the output from regressing the earnings of each of the sectors and the broader markets against key macroeconomic variables (interest rates, GDP growth, commodity prices and credit spreads) to test these hypotheses. For infrastructure, interest rate and credit spread sensitivity is very high (as expected). However, sensitivity to GDP is only moderately less than the global equity market and sensitivity to commodity prices is around the same. This makes more sense when we look at the weight of the sub-sectors in the index (FTSE Developed Core Infrastructure Index, see below). Around one quarter of the companies by weight are rail operators. As you would expect, demand for rail transport is quite sensitive to economic activity. The importance of oil and gas prices in the cost of transportation and energy generation from utilities explains the exposure to commodity prices in the index. Contrary to expectations, global REITs have less sensitivity to interest rates than global equities (despite higher leverage in the sector), and higher sensitivity to economic growth. AREITs have a higher sensitivity to both interest rates and growth. The high growth sensitivity to both may reflect the high weight of retail centres within REITs and a substantial exposure to property development rather than just leasing, which is inherently riskier. As expected, REITs have no sensitivity to commodity prices. We have also modelled the explicit interest rate sensitivity (relative to EPS) of the asset classes based on pro-forma sector income level statements. This analysis shows that a 1% increase in interest rates would see EPS for infrastructure and GREITs fall around 11%, compared with a 5% fall for global equities. Interestingly, the impact from higher interest rates on AREIT EPS is around half that of the Australian market as a whole. Overall, as we expected, RE&I are more sensitive to interest rates than broader equity markets. This has certainly supported returns in these asset classes in the multi-decade reduction in global interest rates since the 1990s. However, we expect interest rates to generally rise in the future, which will weigh on RE&I returns relative to overall equities. The strongest advocates for RE&I espouse their defensive nature (less sensitivity to economic growth) and inflation hedging capabilities. Our modelling suggests these favourable characteristics are as evident as one would hope. That these asset classes aren’t necessarily doing what they say on the tin should be of no surprise to anyone given their experience since Covid disruptions. Regulated cash flows in infrastructure assets didn’t help when people stopped travelling, energy prices collapsed, and consumer demand crumbled. Similarly, long lease lengths don’t provide much comfort when the tenants in your retail centres and offices walk away from their businesses. Stranded Assets A key question from a strategic asset allocation perspective is: What proportion of the future earnings of RE&I will be eroded by cultural, technological or regulatory changes? Or, in investment lingo, are the assets stranded? Infrastructure For infrastructure companies, the obvious question is what is the likely impact of climate change mitigation policy given their large exposure to carbon intensive energy sources? The chart below shows the carbon emission intensity of sales by GICS sector in the MSCI World Index. Half of the companies by market weight in the infrastructure index are in the utilities and energy GICS sectors. The remainder are in the industrials sector. President Biden recently committed to a ~50% reduction in US carbon emissions relative to 2005 levels) by 2030. Similar reductions will likely be necessary by other countries to meet commitments under the Paris Climate Agreement. Planned reductions in carbon emissions will require a change in business models of many infrastructure companies. Many will also see their business models disrupted by the technological innovation required to meet emission targets. As an example, many major European countries, as well as the UK, China and Japan have proposed bans on the sale of internal combustion engine vehicles by between 2030 and 2040. As battery technology continues to improve, electric vehicles will be able to also operate as batteries for houses. This will allow many houses to generate most of their electricity needs (even in the evening) with rooftop solar. This reduces the need for large electricity transmission grids. With distributed generation through rooftop solar, electricity generators will face lower demand (and revenue) at the same time as they need to engage in capex to re-engineer their generation processes to reduce carbon emissions. In a likely sign of regulation to come, many cities in California have banned natural gas connections in newly constructed buildings. This clearly reduces the value of gas pipeline networks. Recently, we asked an infrastructure manager for their thoughts on the above. They responded with modelling showing sharp falls in the valuations of listed infrastructure companies under any climate change policy scenario other than no action. Given the exuberance in the renewables sector, they didn’t see much upside in that space from climate change mitigation policy either. This doesn’t bode well for the longer term returns in the asset class. In addition to climate change policy, in an increasingly populist world, there could be pressure to reduce the regulated rate of return on assets (what politician doesn’t like lower utility prices) or even nationalise assets. While the latter sounds extreme, the UK labour party went to the 2019 general election with a policy to nationalisation of rail, mail, water and energy assets. Real Estate For real estate, the retail sector (shopping centres etc) has been facing headwinds due to the emergence of online shopping and the oversupply of retail space for quite a few years. To some extent, this has been offset by strength in the industrial and warehousing sector, which has clearly benefited from the Amazon effect. Covid accelerated this trend, putting the last nail in the coffin of unprofitable retailers. This, in and of itself, isn’t a sufficient reason to not invest in REITs. It is a well-known thematic and should be in the price of the underlying securities. Property managers are also investing heavily in repurposing space, which could also offset some of the damage depending on how successful they are. The other thematic which needs to be considered is the post-Covid work from home phenomenon. It is increasingly clear that most of the workforce who can work from home do not want to be in an office five days per week. Australian CBD vacancy rates actually increased between July 2020 (when restrictions on office gathering were largely still in force) and January 2021 (when most restrictions had been removed). However, it is also clear that most of the workforce do not want to work from home all the time. This leaves employers (who on average want their workforce more in the office than their workforce wants to be) in a pickle. The key benefit employers gain from employees working from home is the ability to reduce office floorspace and leasing costs. However, if everyone works from home Monday and Friday and comes into the office Tuesday to Thursday, that goal isn’t easily achieved. Overall, we think the net impact of working from home will be negative on office vacancy and the sector. These competing interests will resolve themselves, most likely into some mix of structured work from home days for different teams and the return of hot desking. For AREITs, forthcoming office supply with worsen this burden. Over the next three years, the Property Council of Australia project the Melbourne CBD office supply to increase 8%, and the Sydney and Brisbane CBD office supply to increase 5.5%. Assuming no change in demand (which will likely fall in reality as leases expire and businesses renew with less space), this could take the national CBD vacancy rate towards levels seen in the 1990s recession if planned projects aren’t scrapped. Portfolio Construction While the above sounds dire, we must re-iterate that much of this isn’t a particularly startling revelation and the impact should for the most part be in the price. In addition, with return dispersion within the asset classes expected to be high, successful active managers should be able to capture the positive trends while avoiding the losers. These asset classes will still play a role in the portfolio because we still expect positive returns which are somewhat different from those of Australian and global equities. In technical terms, the correlation between the returns of RE&I and broad equities is less than one. That means there is a reduction in expected portfolio volatility from having some exposure to the asset classes. Indeed, we can model the impact on volatility from a stepped increase in the exposure to RE&I to a simple 70/30 portfolio (funded from global equities). This is shown in the chart below. The minimum volatility portfolio has around 8% RE&I. Some readers may recognise that this is a smaller allocation than the 14% we hold in the DSP70 strategic asset allocation. This reflects the depth of our portfolio construction process – we do not simply produce a minimum volatility portfolio as the strategic asset allocation. There are many other considerations not captured here. Still, the example is illustrative of the benefit of portfolio diversity. Conclusions How much exposure to RE&I we hold in our strategic asset allocations will be determined as part of this year’s review process, to be completed in coming months. Our initial modelling work suggests to us that expected returns to these asset classes have fallen, but so have expected returns to most equities given the material rally we have seen since the middle of last year. Outside of the quantitative portfolio optimisation process, we will be giving significant consideration to the potential for stranded assets to weigh on the infrastructure asset class in particular. Even with skilled active management, it could be difficult to navigate a universe with so many potentially impaired names. The information contained in this Market Update is current as at 03/05/2021 and is prepared by Drummond Capital Partners ABN 15 622 660 182, a Corporate Authorised Representative of BK Consulting (Aust) Pty Ltd (AFSL 334906). It is exclusively for use for Drummond clients and should not be relied on for any other person. Any advice or information contained in this report is limited to General Advice for Wholesale clients only. The information, opinions, estimates and forecasts contained are current at the time of this document and are subject to change without prior notification. This information is not considered a recommendation to purchase, sell or hold any financial product. The information in this document does not take account of your objectives, financial situation or needs. Before acting on this information recipients should consider whether it is appropriate to their situation. We recommend obtaining personal financial, legal and taxation advice before making any financial investment decision. To the extent permitted by law, Drummond does not accept responsibility for errors or misstatements of any nature, irrespective of how these may arise, nor will it be liable for any loss or damage suffered as a result of any reliance on the information included in this document. Past performance is not a reliable indicator of future performance. This report is based on information obtained from sources believed to be reliable, we do not make any representation or warranty that it is accurate, complete or up to date. Any opinions contained herein are reasonably held at the time of completion and are subject to change without notice.Sunset for REITS & Infrastructure?