It is an understatement to say that COVID19 has taken us on a wild ride.

16/03/2020

Market Update – April 2020

06/04/2020

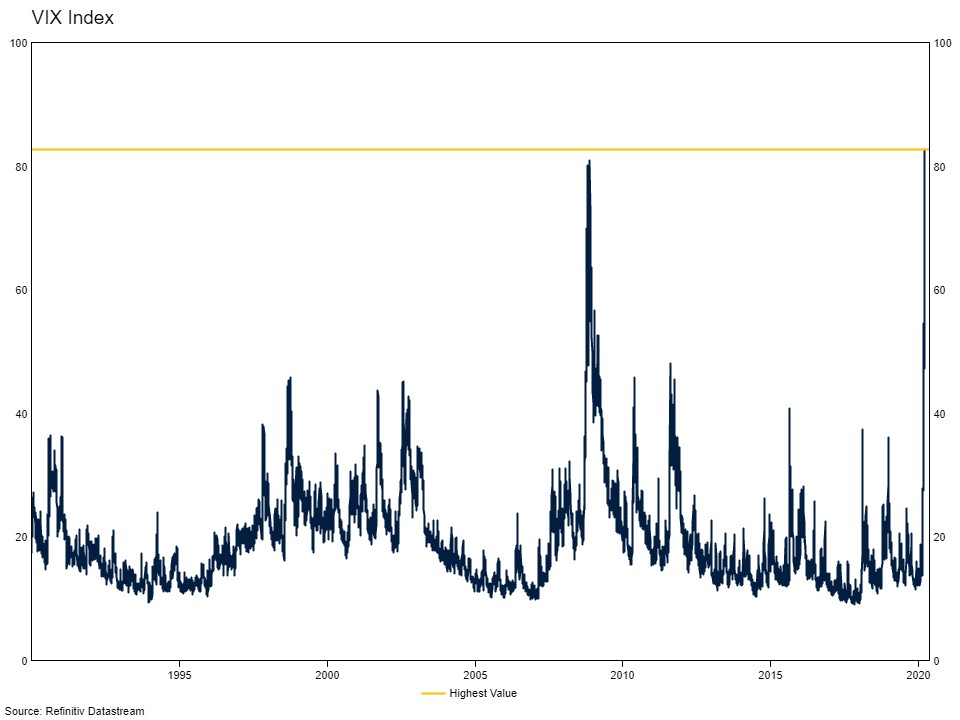

Global equities peaked one month ago and have corrected around 30% since that time. That is the fastest 30% correction on record, with market volatility not seen since the Financial Crisis and the Great Depression – clearly investors are concerned. The VIX Index – which proxies expectations for market volatility in the near term, has hit a record high (see below chart). Peak fear is often a reasonable time to buy equities, particularly if you have a long-term investment horizon. While the elevated VIX does mean that the market has dislocated and investors are exceptionally fearful, during the GFC global equities bottomed only around 4 months after the VIX hit its peak in November 2008.

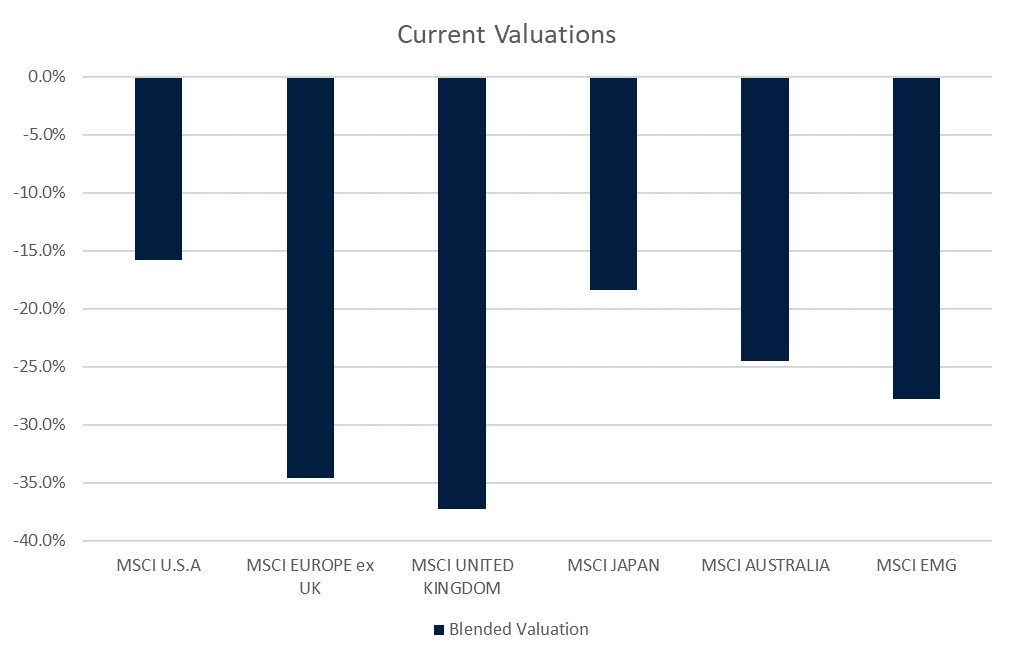

In response to these conditions, liquidity support from central banks has been exceptional and fast – unlike the financial crisis where some central banks were a day late and a dollar short (the RBA and ECB hiked rates in 2008). We have already seen emergency interest rate cuts, multiple new lending and repurchase facilities and more quantitative easing. We may see more if these measures do not fix the issues in funding markets. In addition, the correction in markets has improved valuations materially[1]. We think global equities are now around 20% cheap. Australian and emerging market equities are slightly cheaper still. Over a longer-term investment horizon, this valuation reversion has improved the expected returns to all equity markets meaningfully.

Source: Drummond Capital Partners

Source: Drummond Capital Partners

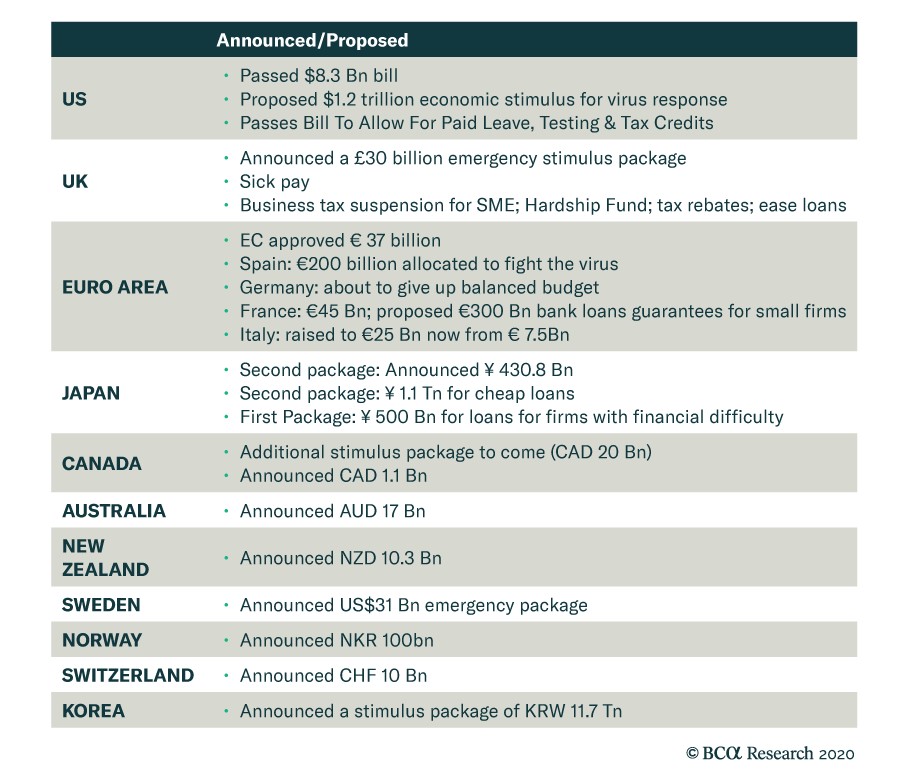

The above suggests that the 30% correction we have just faced would normally present a very attractive equity buying opportunity. However, there remain several things to be concerned about, which we think will continue to weigh on markets in the shorter term. Along with the myriad issues we have raised in previous updates, (Coronavirus, US corporate leverage, falling oil prices and market illiquidity) fiscal sustainability now appears to be a concern to markets. Governments are rightly deploying fiscal stimulus to try and offset the economic impact of the fight against the Coronavirus (see table below). These commitments are likely to continue to grow in the coming days and weeks.

Fiscal Stimulus Package

However, the fiscal position of most developed market economies in the lead up to this crisis has been quite weak. The US Federal Government has a deficit of around 4% of GDP. After accounting for the announced fiscal stimulus ($1.2 trillion so far) and the impact of falling revenues and higher expenses (unemployment etc) in an impending recession, the budget deficit could rise beyond what it did in the Financial Crisis. We think that concerns about the deficit will weigh on the minds of investors in the period ahead and put pressure on government bond prices. This is a key consideration for investors in government bonds, the traditional safe haven asset in times of market stress. The Australian Government however is in the fortunate position of having relatively low debt / GDP, which coupled with record low interest rates gives it the capacity to significantly stimulate the economy.

As the economic damage from the fight to contain the Coronavirus becomes more apparent, equity markets could continue to waver. However, potentially balancing this in the weeks ahead will be new case announcements out of the European countries which have implemented lockdowns – particularly Italy. If evidence builds that the measures Italy has taken are sufficient to halt the spread of the virus, and they can begin to re-open their economy combined with the meaningful stimulus now in the system, the scene could be set for a meaningful rally in equity markets. At this stage, the outlook is still too uncertain to form a strong view that equities are a great buy, but this could change rapidly as events unfold.

[1] We have a bespoke approach for valuing equity markets. We do not assume a reversion to long run average. We construct a fair value Forward PE and Shiller PE by applying the historic average equity risk premium to our long run expectations for risk free interest rates in each major region. We then adjust these required earnings yields higher (meaning a lower fair value PE) by the reduction in economic growth expected in the future relative to history for each market.

The information contained in this article is current as at 23/03/2020 and is prepared by Drummond Capital Partners ABN 15 622 660 182, a Corporate Authorised Representative of BK Consulting (Aust) Pty Ltd (AFSL 334906). It is exclusively for use for Drummond clients and should not be relied on for any other person. Any advice or information contained in this report is limited to General Advice for Wholesale clients only.

The information, opinions, estimates and forecasts contained are current at the time of this document and are subject to change without prior notification. This information is not considered a recommendation to purchase, sell or hold any financial product. The information in this document does not take account of your objectives, financial situation or needs. Before acting on this information recipients should consider whether it is appropriate to their situation. We recommend obtaining personal financial, legal and taxation advice before making any financial investment decision. To the extent permitted by law, Drummond does not accept responsibility for errors or misstatements of any nature, irrespective of how these may arise, nor will it be liable for any loss or damage suffered as a result of any reliance on the information included in this document. Past performance is not a reliable indicator of future performance.

This report is based on information obtained from sources believed to be reliable, we do not make any representation or warranty that it is accurate, complete or up to date. Any opinions contained herein are reasonably held at the time of completion and are subject to change without notice.