Market Update – February 2020

25/02/2020

Oil Prices Darken An Already Cloudy Outlook

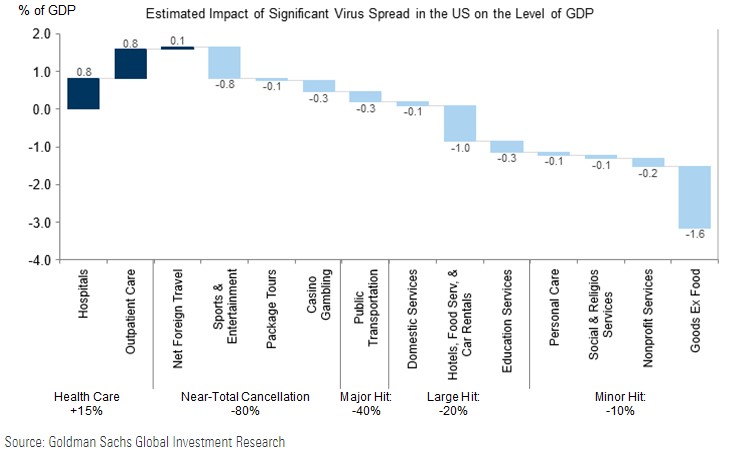

12/03/2020 The last week has been exceptional, both in terms of market movements (see chart below) and how quickly the outlook for the global economy has evolved. Last Monday, we outlined our view that it seemed likely that containment of the novel coronavirus within China had failed. Data released since then has supported that view, with large outbreaks in Iran, South Korea and Europe. The alternative to social isolation is letting the virus spread unhindered through the population. In this scenario, a large portion of the population is likely to miss work for extended periods of time due to personal illness or caring for loved ones. Hospital systems could become overloaded, increasing the mortality rate of the disease. If there is a choice between a sharper economic contraction with a quicker rebound but more fatalities or a shallower, but longer economic correction with fewer fatalities, our assumption is Governments will continue to favour the latter. Either way, we expect economic data to be released in coming months will be extremely weak. Extrapolation of recent Asian economic data into the rest of the world almost certainly implies a decline in global economic activity in coming months. In scenario analysis conducted by Goldman Sachs, the impact of the virus on the US consumer, assuming near total cancellation of large gatherings (80% less spending) and a moderate pullback in less social, but still discretionary, “at risk”, consumption (10% less spending) would see a 1.6% reduction in the level of US GDP over the period it continued (see below). This effect is in addition to the drag on growth due to supply chain disruptions (expected to reduce growth by a further 0.65% on average this quarter and the next). This analysis also assumes no second-round effects from the growth slowdown, such as increased unemployment. Governments and central banks will try and offset the economic weakness via stimulus measures. Markets are already pricing more rate cuts across the world. However, lower interest rates don’t really help if people can’t leave the house. Governments could be more helpful by easing cash flow constraints on households. Applying this additional growth slowdown (assuming a cumulative 3 months of disrupted activity in the next two quarters) to our earnings models would see global EPS fall by around 5%. We would also expect continued multiple compression in this fearful environment. Typically, in a recession the US forward PE falls between 20% and 60%. So far, the multiple has fallen around 10% in the US, pricing in little risk of a further growth slowdown. While we still think there should be a strong recovery in the second half of the year, markets are unlikely to price in this rebound until we have more certainty around the impact of the virus, both in terms of its severity and its economic impact. A more immediate recovery in markets could be sparked by progress on a treatment for the virus (a drug called Remdesivir is in clinical trials) or a meaningful downward revision in current estimates of the transmissibility and severity of the virus. Equity markets rallied very strongly on Monday night in response to central bank stimulus hopes. Chinese authorities announced additional stimulus measures on the weekend, including loan repayment holidays for affected businesses. Governor Kuroda said the Bank of Japan would “strive to provide ample liquidity and ensure stability in financial markets.” G7 Finance Ministers and Central Bank Governors plan to hold a conference call Tuesday (US time) to discuss a response to the outbreak. We think this presents a good opportunity to reduce equity risk in the portfolios and position for our central case view of continued equity market weakness. As a result, following our reduction in equity exposure last week, today we reduced further, to below neutral. The information contained in this Market Update is current as at 05/03/2020 and is prepared by Drummond Capital Partners ABN 15 622 660 182, a Corporate Authorised Representative of BK Consulting (Aust) Pty Ltd (AFSL 334906). It is exclusively for use for Drummond clients and should not be relied on for any other person. Any advice or information contained in this report is limited to General Advice for Wholesale clients only. The information, opinions, estimates and forecasts contained are current at the time of this document and are subject to change without prior notification. This information is not considered a recommendation to purchase, sell or hold any financial product. The information in this document does not take account of your objectives, financial situation or needs. Before acting on this information recipients should consider whether it is appropriate to their situation. We recommend obtaining personal financial, legal and taxation advice before making any financial investment decision. To the extent permitted by law, Drummond does not accept responsibility for errors or misstatements of any nature, irrespective of how these may arise, nor will it be liable for any loss or damage suffered as a result of any reliance on the information included in this document. Past performance is not a reliable indicator of future performance. This report is based on information obtained from sources believed to be reliable, we do not make any representation or warranty that it is accurate, complete or up to date. Any opinions contained herein are reasonably held at the time of completion and are subject to change without notice.Stimulus hopes an opportunity to reduce portfolio risk

Source: Drummond Capital Partners

Source: Drummond Capital Partners

Source: Drummond Capital Partners

Source: Drummond Capital Partners