It pays to think about your time as money

07/12/2017

Affinity Insights – Issue 3, December 2017

22/12/2017November Market Performance

The Pulse

- The global economy continues to generate synchronised growth and markets are expecting these conditions to continue into 2018.

- In the US, both houses of Congress have approved bills to reform and lower corporate and personal taxes paving the way for new tax laws in coming months.

- In Europe, business conditions are at 16-year highs suggesting that the Eurozone can continue to generate above-average economic growth.

- In China, regulators continue to try to reign in credit growth and curb speculative investment.

- The Australian economy is being impacted by weak wages growth which is leading consumers to rein in spending.

Global economies

Economic news over the past month has confirmed that the major economies are continuing to enjoy relatively healthy growth in the second half of 2017 with falling unemployment and robust business and consumer sentiment surveys suggesting that current economic conditions can continue into next year.

US

In the United States, separate tax reform bills were passed in both the House of Representatives and Senate, paving the way for tax cuts for both companies and individuals assuming that the two bills can be reconciled. For major companies, the headline tax rate is expected to fall from 35% to 20% and, all else being equal, this should boost corporate earnings, but risks saddling the economy with higher levels of government debt if the tax cuts don’t stimulate higher economic activity. With full employment and strong economic conditions and the likely fiscal stimulus from tax cuts, the US Federal Reserve under new Chairman, Jerome Powell, is likely to continue to normalise interest rates over the next two to three years. Higher short term US interest rates and the repatriation of offshore cash holdings by US multinational companies, due to proposed tax changes, is also likely to be supportive for the US Dollar given a significant portion of the US$2.6 trillion in estimated cash holdings are held in foreign currencies.

Europe

In the Eurozone, the economy continues to perform strongly with retail sales growing 3.7% year-on-year, reflecting recent strong consumer sentiment readings. The purchasing manager surveys for the Eurozone have also continued to strengthen with the composite PMI index at a new cyclical high in November suggesting that the Eurozone economy should be growing at about a 3.5% year-on-year, higher than last quarter’s 2.5% growth rate. Manufacturing activity has been particularly strong with the November manufacturing PMI at 60.1, which was only the second time in the 20-year survey’s history that more than 60 has been recorded.

China

Chinese activity data slowed more than expected in October and business surveys in November have also pointed to slower activity. The slowdown appears to relate to government efforts to close capacity in the metals sector to help reduce pollution. Housing construction has also slowed following government efforts to curb real estate speculation. In November, the Chinese government announced additional policy reforms aimed at reducing risks in the shadow banking industry by restricting internet micro-lending and regulating “wealth management products” which have been used by banks and trust companies to help finance real estate speculation.

Asia region

In Japan, the preliminary estimate of quarterly real GDP growth slowed to 0.3%, marginally below expectations. This was the seventh consecutive positive quarter for growth and was enough to boost annual growth from 1.4% to 1.7%, which is above the Bank of Japan’s estimate of potential growth (of just 0.5-1.0%). However, even though the unemployment rate remained at a 23-year low of 2.8% in October, Japanese consumers are reluctant to spend with core household spending down 0.6% year-on-year. The weak consumer spending has seen the Bank of Japan’s new preferred core measure of inflation – which excludes the prices of fresh food and energy – rise only 0.2% year-on-year in October, well below their 2% target rate.

Australia

In Australia, the economy grew slightly less than expected, expanding 0.6% in the September quarter with household consumption growth particularly weak. This was likely linked with the weak wages growth which rose only 0.5% over the quarter despite the increase in the minimum wage in July. However, the economy continues to generate strong jobs growth and with business conditions at elevated levels the robust employment conditions should continue into next year.

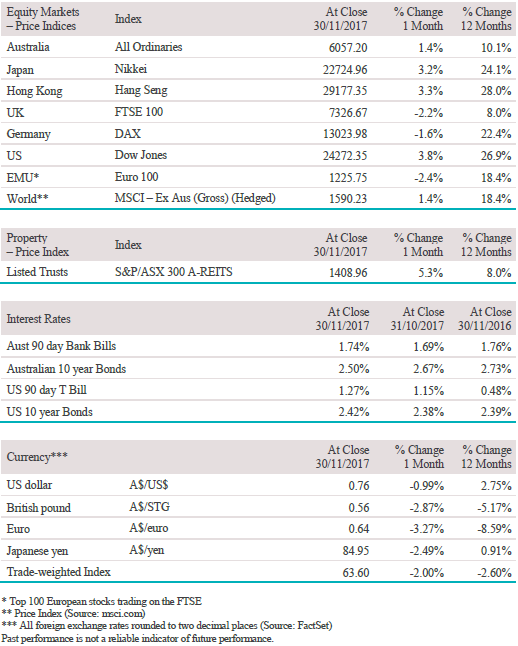

Equity Markets

- Developed market shares rose 1.6% and emerging market shares fell 0.8% in local currency terms.

- The German DAX Index fell 1.6%.

- The Euro 100 index lost 2.4% over the month.

- The Japanese Nikkei 225 Index was 3.2% higher.

- The US Standard & Poor’s 500 Index was up 3.1% in November and has returned 20.5% year-to-date.

- Australia’s S&P/ASX All Ordinaries Index rose 1.4%.

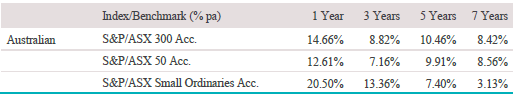

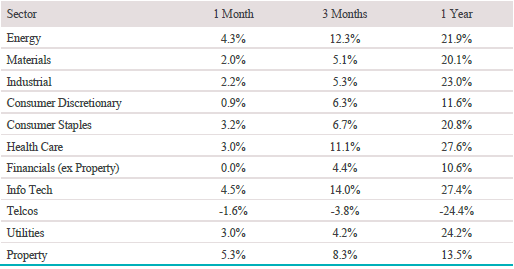

Australian Equities

The S&P/ASX 200 Accumulation Index continued its recent strong run finishing up 1.6% in November in line with developed market global equities. Within the Australian equity market the best performing sectors were REITs (+5.3%), energy (+4.1%) and consumer staples (+3.2%). REITs were led by Westfield Corporation (+7.9%), Investa Office Fund (+7.1%) and GPT (+6.3%). Within the energy sector the standouts were Santos (+12.9%) and Origin (+12.5%) and in the battered telecommunications sector, TPG Telecom (+10.2%) and Vocus Group (+9.0%) posted strong returns.

The telecommunication sector underperformed (-1.6%), in spite of the performance of Vocus and TPG, while the heavyweight sector of financials was unchanged for the month. The weakness in telecommunications was solely due to Telstra being down 3.1% while National Australia Bank (-6.5%), ANZ Banking Group (-2.3%) and Westpac Banking Group (-1.8%) all weighed on the broader market. Banks suffered due to a combination of weak results and a banking Royal Commission announced on the last day of the month.

Big movers this month

Going up:

Property 5.3%

Information Technology 4.5%

Energy 4.3%

Going down:

Telecommunications -1.6%None

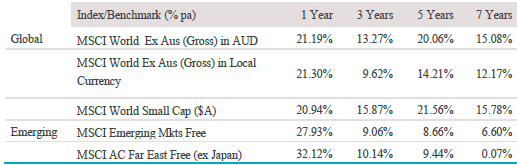

Global equities

The MSCI World ex-Australia Index (in local currency terms) returned 1.6% in November, however, a decline in the Australian Dollar meant the index rose 3.3% in Australian Dollar terms. Every sector except materials was higher over the month with materials shares posting a small loss of 0.1% while the best performing sector was energy, which rose 3.0% helped by the oil price which rose almost 6% due to the OPEC and Russian agreement to extend oil production cuts to the end of 2018. Information technology shares, which are less likely to benefit from the US tax cuts, rose only 1.0% in November although they remain 40% higher year-on-year.

Property

The S&P/ASX 300 A-REIT Accumulation Index (which includes distributions) returned 5.3% in November helped by the fall in the Australian ten-year government bond yield. Over the past year, property securities have returned 13.5%, including distributions, outperforming international property securities which returned 12%.

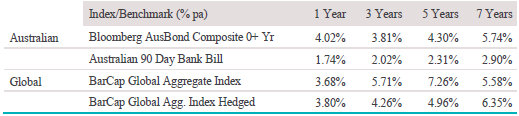

A-REITs have also outperformed currency-hedged Global REITs over three, five and seven years.

Fixed interest

Australian bonds returned of 0.87% over the month as government bond yields fell in Australia due to lower-than-expected wages growth data and commentary from RBA Governor, Philip Lowe, who suggested interest rate rises may be at least a year away. Two-year Australian Commonwealth Government bond yields fell from 1.83% to 1.76% per annum (which is now lower than the US equivalent yield of 1.79% per annum) and the ten-year bond yield fell from 2.68% to 2.52% per annum resulting in a flatter Australian yield curve.

Internationally, the Bloomberg Barclays Global Aggregate Bond Index (A$ hedged) returned 0.19% as yield curves flattened in the United States, United Kingdom and Germany with rises of 6-19 basis points in two-year yields but little movement in longer term yields. While yield curve flattening can often signal greater chances of a recession, in this case the rises are mainly driven by increased chances of short term interest rate rises from central banks in Europe and North America.

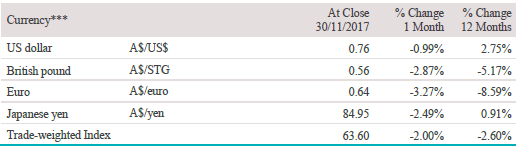

Australian dollar (AUD)

The Australian Dollar fell 1.0% against the US Dollar in November and on a trade-weighted index basis, the Australian Dollar lost 2.0% for the second month in a row even though the US Dollar also fell, by 1.6% on a trade-weighted basis, and iron ore prices rose 5% over the month.

The information contained in this Market Update is current as at 11/12/2017 and is prepared by GWM Adviser Services Limited ABN 96 002 071749 trading as ThreeSixty Research, registered office 105-153 Miller Street North Sydney NSW 2060. This company is a member of the National group of companies.

Any advice in this Market Update has been prepared without taking account of your objectives, financial situation or needs. Because of this you should, before acting on any advice, consider whether it is appropriate to your objectives, financial situation and needs.

Past performance is not a reliable indicator of future performance. Before acquiring a financial product, you should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product.