Australian Bushfires: How we can help

17/01/2020

Market Update – February 2020

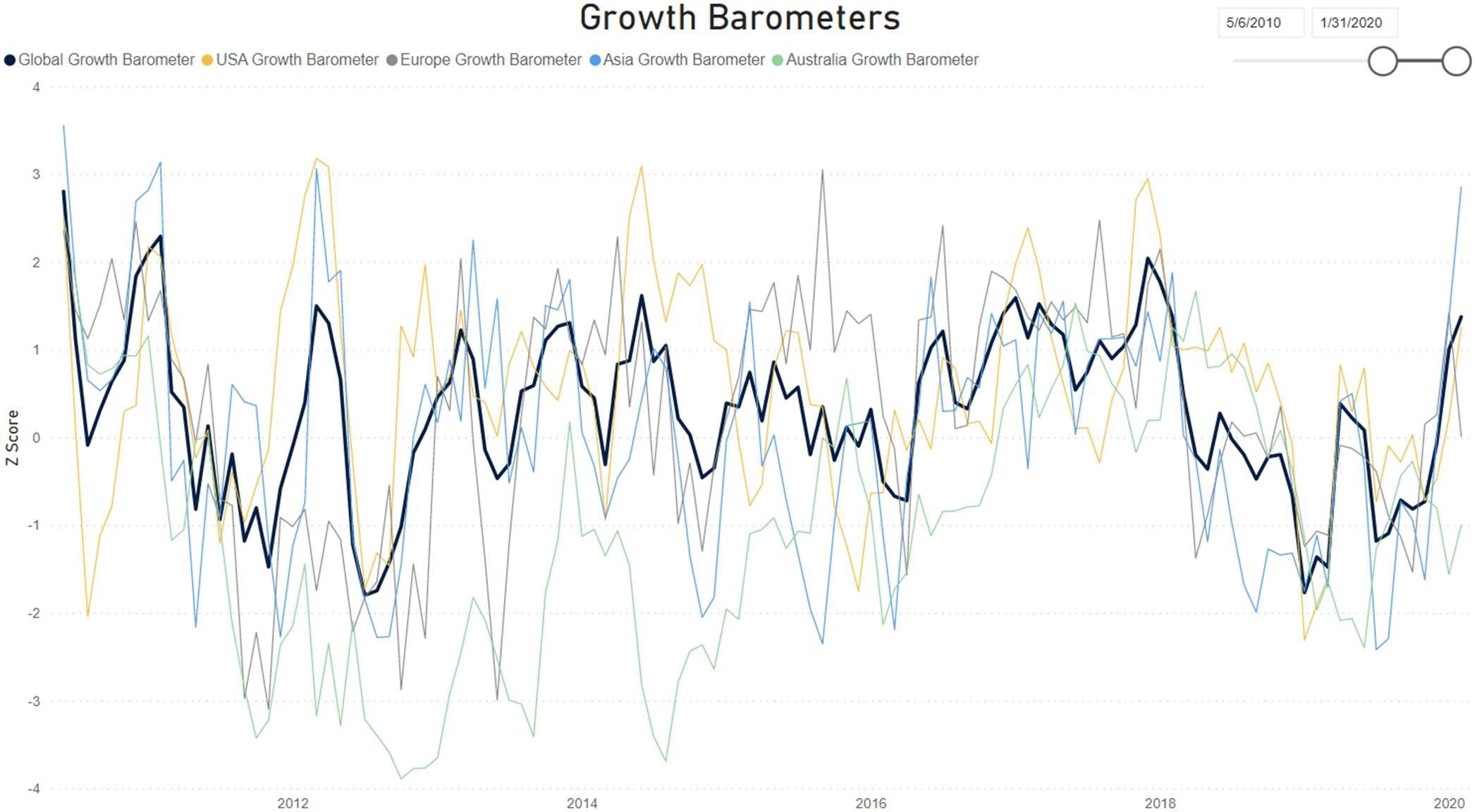

25/02/2020We don’t think so, but there are some caveats and risks. Prior to the outbreak, we were constructive on the outlook for global growth and risk assets. Monetary policy around the world became materially more accommodative, trade tensions between the US and China eased and our barometer for global growth had accelerated meaningfully (see charts below). We are still constructive, but think the ride will be rocky.

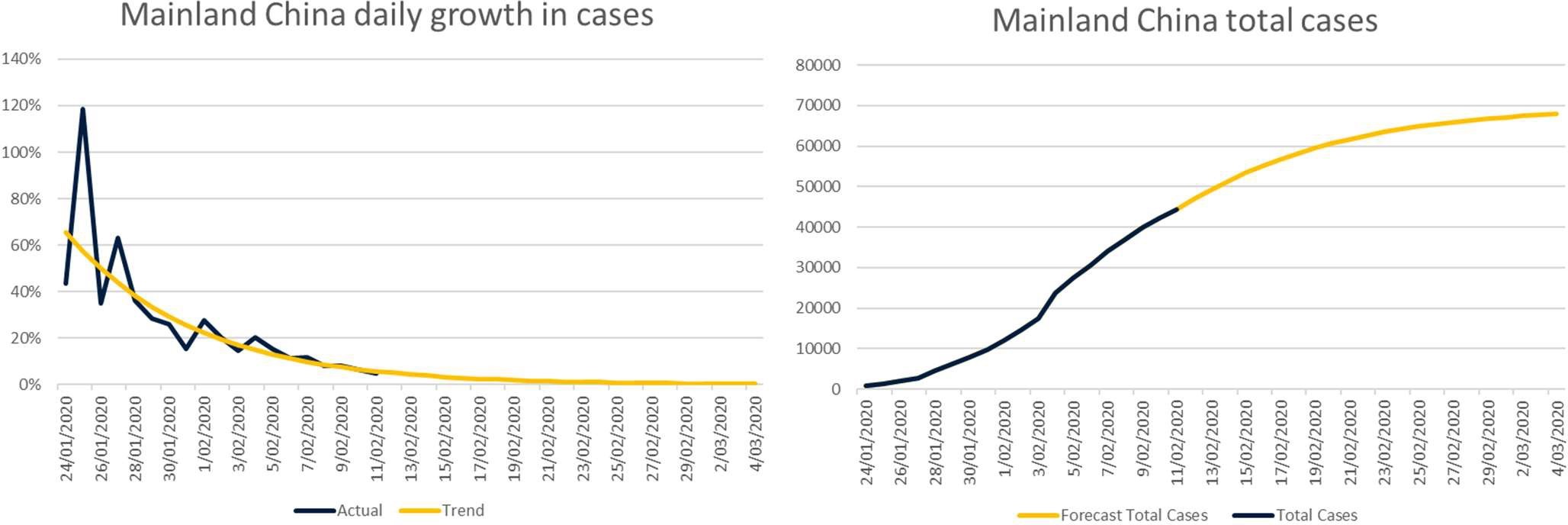

Source: John Hopkins CSSE

Where we can provide more market insight is around the economic impact of the efforts to contain the virus, the “second round” effect. While we do not want to understate the human cost of the virus, it appears as though the containment efforts will have a much more meaningful economic cost – at least in the short term. The freedom of movement of millions of Chinese citizens has been restricted, businesses have been closed long beyond the normal Chinese New Year holiday period and international travel outbound from China has been all but shut down. All of this suggests that Chinese economic growth in the 1st quarter will be terrible. During the SARS epidemic, Chinese growth nearly halved in the worst affected quarter, and Coronavirus is likely to have a much larger impact. China is also a much larger economy than it was in 2003, suggesting that growth elsewhere is likely to be severely impacted as supply chains are disrupted.

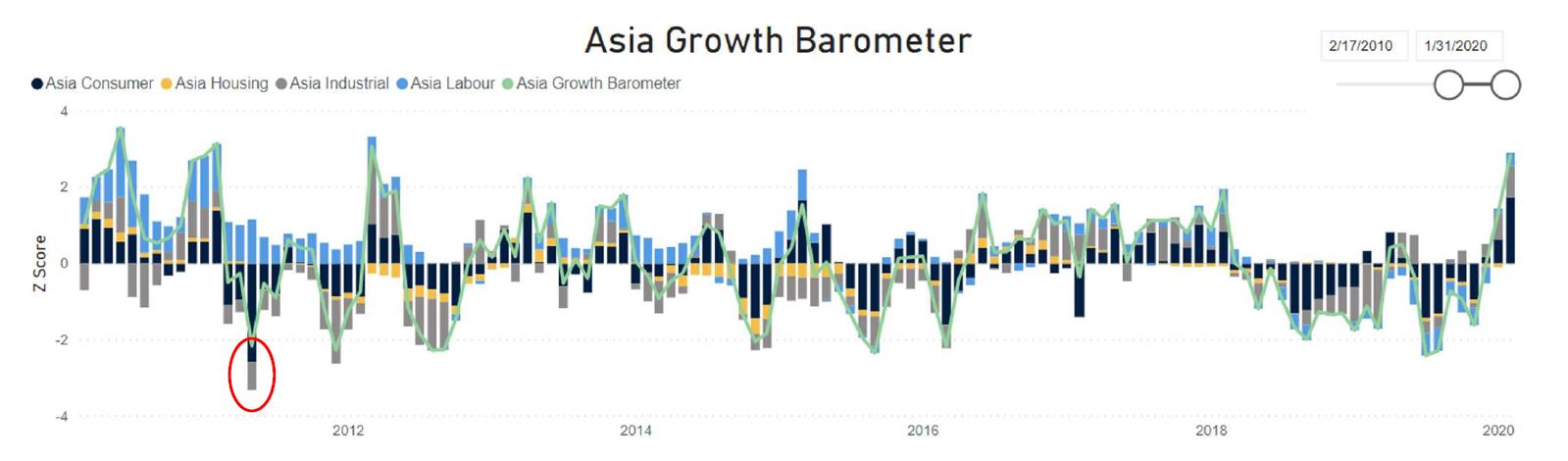

Prior to Coronavirus, it had appeared as though there has been material improvement in economic growth in Asia in the three months to January 2020, driven by the consumer and a resumption of the industrial production cycle.

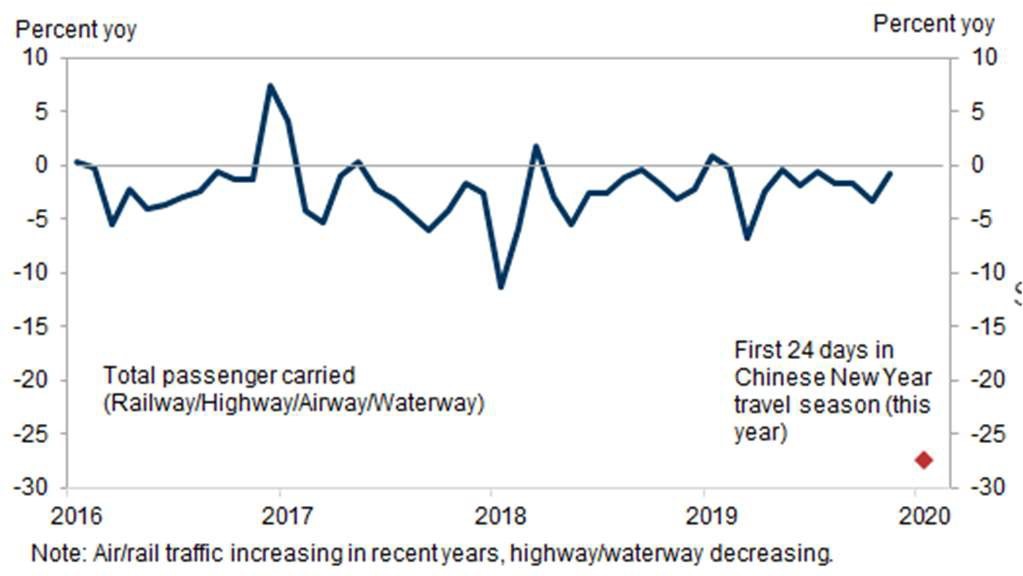

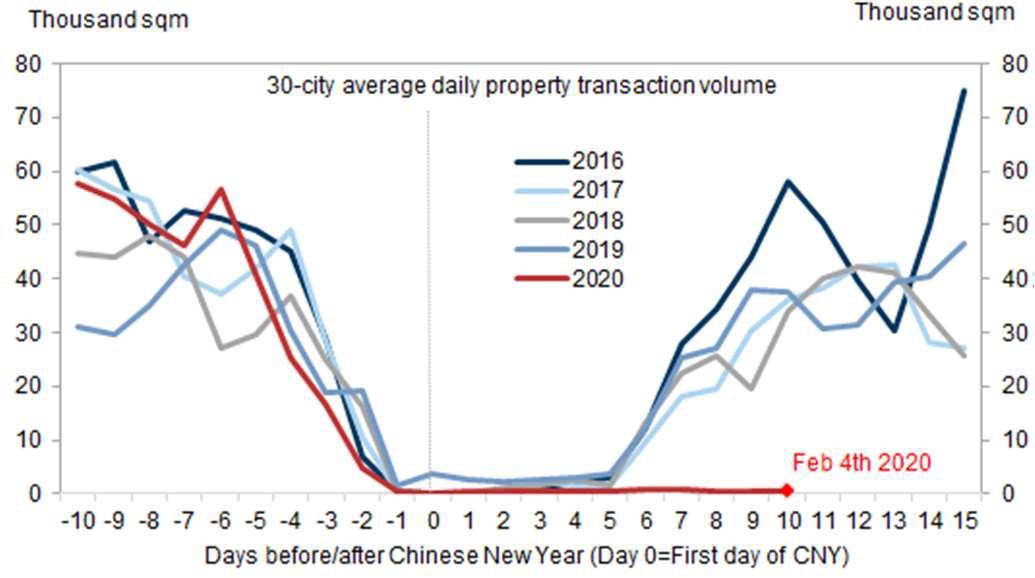

Our expectation is that Asian growth will hit an air pocket in February, collapsing significantly. Growth outside of Asia will also likely slow. We expect profit warnings from corporates, which could flow through to weaker consensus earnings expectations. Higher frequency data released so far suggest that the lockdown has severely impacted the transportation and real estate sectors (see Charts below) in China.

Passenger Volume Property Sales

Source: Golman Sachs, WIND, NBS

Estimates of the impact on global growth from Coronavirus released so far vary widely and are changing rapidly. Some believe the impact will be material – around a 1.5% – 1.75% point drag in Q1 (BCA Research and Goldman Sachs). Positively, gaps in global growth due to exogenous shocks tend to be quite transitory. Supply chains recover and growth usually rebounds in the following quarters. A contemporary reference point was the 2011 Tōhoku earthquake and tsunami in Japan, circled in red in the chart above. Most forecasters are expecting a sharp rebound in global economic growth in Q2. To support growth, the Chinese central bank (PBOC) has lowered policy rates and supported lending markets through large injections of liquidity. China has also lowered some tariffs against US imports. Our central expectation is that equity markets will eventually see through the impact of the virus and anchor themselves on prospects for continued global economic growth through 2020. That said, we expect market volatility while uncertainty regarding the virus and its economic impact persists.

A key risk to this outlook is the potential underreporting of infections in China. The investment community treats the accuracy of Chinese economic statistics with a healthy degree of scepticism. There is a very real risk that the number of cases in China (both level and change) is far higher than currently reported by Chinese authorities. If this is the case, the economic impact of the virus could be far greater than currently appreciated. To gauge the probability of this risk, we are keeping a keen eye on the number of daily reported cases outside of China, particularly Hong Kong. At this stage, these are also supporting the containment hypothesis. If evidence builds that the virus has not been contained, we will adjust the portfolios accordingly.

The information contained in this article is current as at 18/02/2020 and is prepared by Drummond Capital Partners Pty Ltd. Any advice or information contained in this report is limited to General Advice for Wholesale clients only.

The information, opinions, estimates and forecasts contained are current at the time of this document and are subject to change without prior notification. This information is not considered a recommendation to purchase, sell or hold any financial product. The information in this document does not take account of your objectives, financial situation or needs. Before acting on this information recipients should consider whether it is appropriate to their situation. We recommend obtaining personal financial, legal and taxation advice before making any financial investment decision. Past performance is not a reliable indicator of future performance.

This report is based on information obtained from sources believed to be reliable, we do not make any representation or warranty that it is accurate, complete or up to date. Any opinions contained herein are reasonably held at the time of completion and are subject to change without notice.