Investment Research – November 2019

29/11/2019

The Puppet Master – Can you Trust a Trust?

18/12/2019Issue 11, December 2019

From the MD's Desk

By Rodney M. DeGabriele – Principal & Managing Director

Welcome to Affinity Insights!

With the festive season right around the corner and as the year draws to a close, we reflect on what we have accomplished this year. We would like to express our gratitude for your continued support and commitment and look forward to working with you in 2020. Please enjoy some well-deserved rest with family and friends during this holiday season.

We were thrilled to host a luncheon at the Cancer Council Victoria in November where we were invited to hear from CEO Todd Harper and Prof. Melanie Wakefield AO, who shared their insights into their groundbreaking work on behavioural interventions to “Stop Cancer Before it Starts”.

Our office will be closed from 5pm on Friday 20th December 2019 and will reopen again on Monday 13th January 2020.

We do hope you like this issue of Affinity Insights, and we welcome any feedback or suggestions for future topics.

Cancer Council Victoria Luncheon

Thank you to all those who attended our end-of-year lunch at Cancer Council Victoria. We hope that you found the lunch valuable.

It was an opportunity for behind the scenes insight into the ambitious work of Cancer Council Victoria and their plans to Stop Cancer Before it Starts. With presentations from Professor Melanie Wakefield AO Director of the Centre for Behavioural Research in Cancer and Todd Harper CEO, we learnt about the innovative research, behavioural science and the economics of health that are being used to tackle cancer both nationally and globally, and what Cancer Council is planning next.

We would like to thank everyone at Cancer Council Victoria who took time of out of their day to share their knowledge with us. If you are interested in having a discussion with Cancer Council about how you could become involved, please contact Todd Harper, CEO on todd.harper@cancervic.org.au.

Affinity will endeavor to host similar events in the future and welcome your suggestions for ideas.

Introducing Marleine Attallah

Marleine joins the Affinity team as an Associate. Marleine has completed her Bachelor of Accounting and attained positions in both the Accounting and Banking fields. She is currently studying a Master of Financial Planning as she values education and is always looking to further develop her knowledge of the industry.

Marleine’s passion truly lies in establishing and maintaining meaningful relationships with clients while ensuring they have a seamless experience at every interaction. Marleine works closely with internal and external service partners to ensure every client is put in the best possible financial position, ensuring their assets are protected, their wealth is maximised and their day to day needs are well taken care of.

We would like to welcome Marleine to the team and wish her all the best.

Interest rate cuts – doing more harm than good?

Over the past months Australia has watched the RBA cut rates from 1.50% to 0.75%. However, it has been more than a decade since 100% of RBA rate cuts have been passed onto borrowers by Australia’s commercial banks. Of the last three rate cuts only 50% have been handed onto borrowers.

The ever-expanding gap between RBA cash and mortgage rates continues to diminish any impact the RBA hopes to achieve, reducing the effect of their monetary policy transmission mechanisms in Australia.

Rate cuts have not stimulated growth, although it has had some impact on house prices, with housing data indicating improving conditions. The household sector on the other hand is not doing so well with slow jobs and wages growth. Over the next sixth months unemployment is predicted to increase by 0.5%.

Unlike the US, Australia’s retail sales have not rebounded. For the first time since the recession in the 1990s, they have contracted compared with a year earlier.

The RBA has recently voiced their concern of further rate cuts doing more harm than good. Recent consumer and business confidence decline supports this view.

We are seeing a lot of warning signs, but none of the above assures a looming recession. The bond market has been warning of it but the equity markets remain near historic highs.

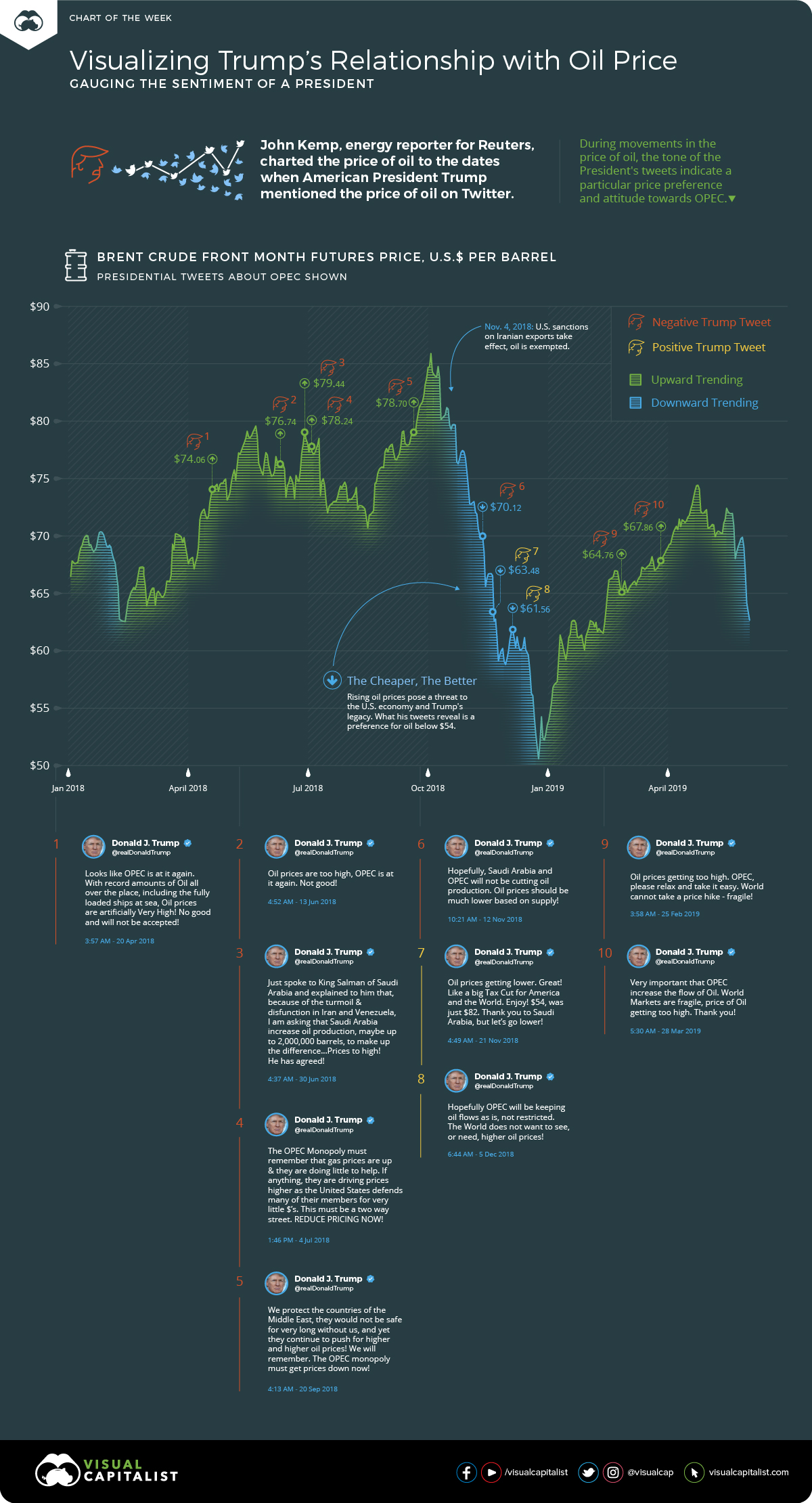

Trump’s Relationship with Oil Price

The Puppet Master – Can you Trust a Trust?

In the Full Court decision of Harris & Dewell and Anor, the Court considered, amongst other things, whether a Unit Trust legally owned by the husband’s 99-year-old father was the husband’s “puppet” or “creature”, and therefore matrimonial property.

The Court ultimately found that the significant assets of the E Unit Trust, legally owned husband’s father, was not matrimonial property of the parties available to divide between them. However, the Full Court did find that the assets and income of the E Unit Trust were a financial resource of the Husband, which he could continue to rely upon in the future.

To continue reading this article and find out how the court came to this conclusion click here