Market Update – September 2017

28/09/2017

Marriage equality in the workplace

12/10/2017Issue 2, October 2017

From the MD's Desk

Welcome to Affinity Insights

The first quarter of the financial year has been a busy one. We have welcomed a Finance Specialist to our team, Sarah Wells, we held a client function with Morgan Stanley’s Head of Research, Nathan Lim, and I recently returned from a conference in Shanghai where the sophistication, speed and efficiency were undeniably defining characteristics.

For me, it reiterated the importance for the need of global infrastructure and reemphasised the untapped opportunities within the Asian region.

With a population close to 35 million people, I was surprised with the cleanliness of a major global city like Shanghai, and how easy it was to get around. The absence of English was in no way a deterrence in the ability to communicate. This just proves how easily accessible the global market is. What that means for efficient business and financial markets, is a better understanding of global investments and better opportunities, and understanding that Australia is part of that global mix.

Coming up this quarter, as part of our ongoing initiatives and for the benefit of our clients, we will be undergoing a review of the cash-flow and expense management programs, Moneysoft and Xero. We will liaise with you directly once we finalise this and make a decision on the most efficient and cost effective solution for you.

I do hope you like this issue of Affinity Insights, and we welcome any feedback or suggestions for future topics.

Please send all comments to: enquiries@affinityprivate.com.au

Introducing our Finance Specialist

Sarah Wells – Finance Specialist

Sarah is an accomplished credit, risk and debt structuring professional with 20 years’ experience in providing finance solutions for busy executives and professionals. We welcome Sarah to the Affinity Private team.

Sarah is passionate in educating and coaching her clients on the best banking and finance strategies available to them through a diverse offering of advice, lending products and solution based services.

In addition to her industry education requirements Sarah holds a Masters in Management (Finance) and has been the recipient of a number of industry service and excellence awards.

Our Opinion

You would have to be living under a rock to have not noticed that borrowing money is getting harder, even for the best of us.

Interest only and investment lending are the new black sheep of our funding family, impart due to our insatiable appetite for debt and the defiant boom of the east coast property market. These factors continue to feed APRA’s concerns about the perfect storm brewing. Could these factors alone trigger Australia’s very own NINJA loan crisis?

So, with all the media ‘gloom and doom’ what does it mean and what do we do? I have seen many cycles in Australia over my 20 years in lending, if I had a crystal ball this would help, given I don’t I have noted down my seven pieces of advice for borrowers, accountants and other related finance professionals to consider thinking about.

My seven pieces of advice

- Adjust expectations, lending over 80% of the property value will in most cases require principal and interest repayments.

- Consider overall debt levels and what are your plans if any to start reducing them, lenders are keen to work with borrowers who are actively reducing debt. You may need to speak with someone to tailor your own plan.

- Keep your tax payments up to date, as of July 1 the ATO will start reporting overdue tax debts to credit reporting agencies. Which will impact your ability to borrow.

- Seek exceptional advice and ensure all advisers are on the same page, with regards to plans and debt levels.

- Think carefully before extending interest only periods for long term investment debt. Everyone should seek advice as it may be more suitable to refinance over a full loan term again. The main reason being that repayments are calculated over a significantly reduced term such as 15 years which can be quite problematic with cash flow management.

- Lenders are now looking at client profiling by way of credit scoring, this has been around for years however these algorithms are being adapted to predict future behaviour and can unfairly prejudice even the most seasoned client.

- Consider alternative options. Many lenders that were seen as ‘lenders of last resort’ for credit impaired borrowers are recognising and tailoring solutions for those that are no longer favoured under the major bank’s new restrictions. I am seeing more and more professional clientele needing to find solutions to problems that weren’t an issue six months ago.

The above are some suggestions to consider thinking about, in order to make an informative decision about what is best for anyone’s individual needs.

Our briefing with Nathan Lim

Catherin Robson with Nick (son of Affinity Private Client)

The briefing with Morgan Stanley’s Head of Research, Nathan Lim was a successful event. Those who attended found it to be insightful and very interesting.

Nathan shared with us his insights on how best to navigate challenging markets and gave us a broader perspective into why markets seem relatively unconcerned about geopolitical risks, where value lies and whether an uninterrupted bull market is possible.

We have obtained a copy of the presentation by Nathan. If you would like a copy, feel free to contact us at enquiries@affinityprivate.com.au We would be happy to forward it onto you.

Admin Updates

ShareFile

As mentioned in our previous newsletter, we have introduced an initiative to protect the privacy of your financial data, which replaces the need to email documents, called ShareFile.

If you have not already registered with ShareFile, it’s easy to get started – please register via the link https://affinityprivate.sharefile.com/Authentication/Login

Your username is your email address and you will be prompted to create a password for your account.

If you have any queries regarding your ShareFile account, please email enquiries@affinityprivate.com.au

Annual Tax Statements

Your annual tax statements from your respective investment platforms are finalising the last tranche of statements for last financial year. You will receive either an email from the platform provider (either Macquarie or MLC) or be provided with a hard copy.

If you have any queries regarding your Annual Statement, please email us at enquiries@affinityprivate.com.au or telephone the office on 1300 769 304.

Supporting our Clients

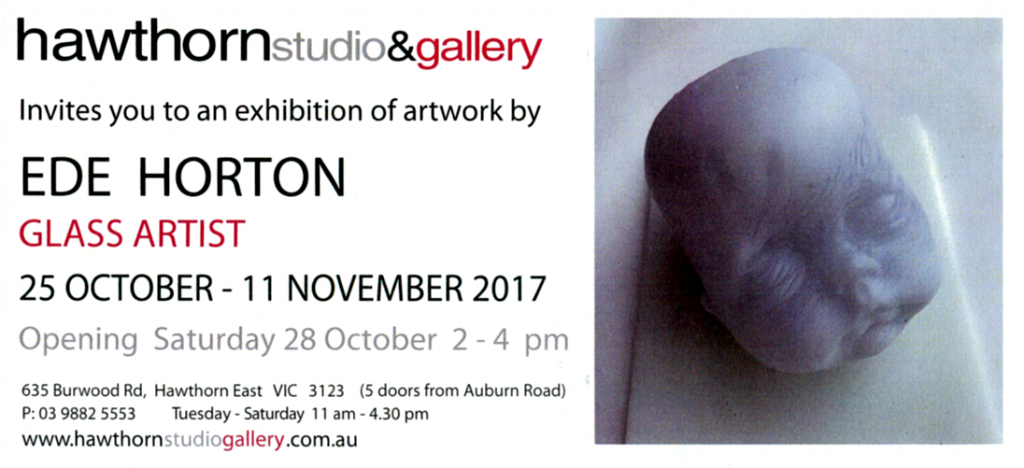

Ede Horton’s passion for glass artistry is recognised internationally.

Her work is represented in many collections, including Parliament House in Canberra, Queensland Art Gallery and The Jewish Museum of Australia in Melbourne, as well as in overseas and regional galleries and many private collections.

Ede’s sculptures focus on emotional vulnerability and personal/cultural identity. Ede thinks of herself as a storyteller. In her work she looks for ways from an historical perspective to talk about how, through the generations, we deal not only with change but how we recognise and retain the richness of our memories and rituals that thread consistently through our lives and define who are.

Ede is showcasing her work at Hawthorn Studio and Gallery from 25 October – 11 November 2017.

Ede Horton is a valued client of Affinity Private and we wish her all the best with her exhibition.

Dr Rory Nathan has over 35 years’ experience in engineering and environmental hydrology. He has spent the majority of his career in private industry, and now focuses his time on research and teaching in the Department of Infrastructure Engineering at The University of Melbourne.

Although, Dr Rory Nathan has made a substantial contribution to industry best practice and his research publications have won several national and international awards, he has written an article that is personal to him and his family titled “Marriage Equality in the Workplace”.

This article is based on his real life experience with his family and has made him think about how poorly we handle diversity in our workplaces.

You can read Dr Rory Nathan’s article here.

Dr Rory Nathan is a valued client of Affinity Private and we support his efforts.