Market Update – November 2023

28/11/2023

Market Update – December 2023

19/12/2023Issue 23, December 2023

From the MDs' Desk

Welcome to our 23rd edition of Affinity Insights.

With 2023 almost over, and the new year fast approaching, we will be taking a little break to spend some time with family and friends, as we hope you will too.

This year has been filled with both challenges and victories. It has been reassuring to see our team rise to meet every hurdle, and still look out for our clients’ best interests. Often, we find our most significant successes in the most surprising places. We are sure it has been the same for you.

We know that the year ahead will bring new challenges and accomplishments. We are excited about what lies ahead as we anticipate a busy 2024.

We wish you all the very best for the holiday season, and hope that 2024 is a year of good health, success and growth for you and your loved ones.

From Rodney M. DeGabriele and Tony Vikram

Festive Season Office Hours

Our office will be closed between the Christmas and New Year holiday period.

We will close from 12 noon on Friday, 22nd December.

We will reopen on Monday, 15th January 2024.

Should you have any queries during this time, please send an email to enquiries@affinityprivate.com.au or if your matter is urgent, please contact either Rodney DeGabriele on 0488 993 175 or Tony Vikram on 0421 344 238.

Market Update - December 2023

In our most recent Market Update, we look towards 2024 and the possible likely scenarios. The outlook is about as uncertain as it can be.

Our latest Market Update is now available to view here.

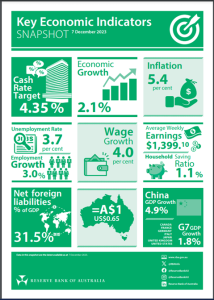

RBA – Key Economic Indicators Snapshot

Below is an infographic which is updated monthly by the RBA, summarising macroeconomic and financial market trends in Australia.

Reference: https://www.rba.gov.au

Drummond: Winner - Multi-Asset Category

Once again, we are delighted to have partnered with Drummond Capital Partners (members of our Investment Committee) who have won the ‘Multi-Asset Category’ at the Institute of Managed Accounts Providers (IMAP) awards. This award comes after being a finalist in the category for three of the last four years which, in itself, is a great achievement.

The judges highlighted the consistent risk adjusted returns, rigorous investment process and the client communications & reporting as factors in their decision making. As members of our Investment Committee their expertise, investment knowledge and advice have proven to be beneficial to our clients’ portfolios during these recent times.

As you all know, we strive to deliver a consistent and smooth investment journey for you, our clients, and having Drummond Capital Partners as members of our Investment Committee, brings expertise, investment knowledge and advice, which has proven to be beneficial to you, our clients’ during these recent times.

Supporting Charities

This year at Affinity, we supported and donated to Glaucoma Australia (through Christmas cards for Charity).

Glaucoma Australia’s purpose is to improve the lives of people with glaucoma and those at risk, by increasing early detection and positive treatment outcomes through education, advocacy, and research. They empower individuals to understand and take an active interest in their own eye health; and promote research, innovation and work collaboratively with health care professionals.

If you would like to find out more information about Glaucoma Australia or to donate, please visit their website at https://www.glaucoma.org.au/

Three scams to watch out for

Impersonation scams

Have you ever received a call from someone, and it just didn’t feel right? It may have been part of an impersonation scam, which is when a scammer impersonates a bank or other service company by phone or SMS, asking you to authorise transactions, make a payment, or provide personal information.

According to the Australian Government’s Anti-Scam Centre, approximately 72% of reported scams include some form of impersonation of a legitimate entity^.

So, how can you be sure next time that the person calling you is really from where they say they’re from? Here’s a few things to remember:

- never transfer funds to another account

- never share passwords with anyone

- avoid using phone numbers or links from text messages

- check contact information using a trusted source such as the company’s website.

Investment scams

Already this year, Australians have lost $240 million to investment scams*. Investment scams are often sophisticated which means they can be hard to spot. Investment opportunities offering fast results and big returns can have the potential makings of a scam.

Common investment scams include:

- unsolicited investment offers such as cryptocurrency, fake corporate or treasury bonds, and fake share IPOs (Initial Public Offerings), claiming to be from reputable businesses

- fake endorsement of an investment or other business opportunities from celebrities

- early access to superannuation with a fee.

Buyer/seller scams

Buying or selling on an online selling platform is great when it’s quick and hassle-free. But scammers are popping up everywhere, so it’s harder to stay safe online. Here are five red flags to look out for:

- being approached by someone who has no profile photo

- the price seems too good to be true

- a request for personal information such as your phone number or email

- the buyer overpays for an item and wants you to refund the excess amount

- the buyer wants to pay using a gift card or wants to send a prepaid shipping label.