Affinity Insights – Issue 15 February 2021

02/02/2021

Market Update – March 2021

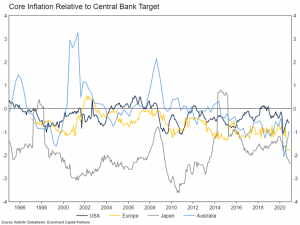

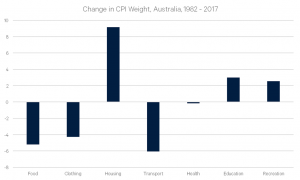

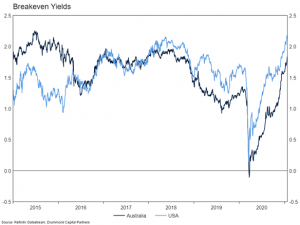

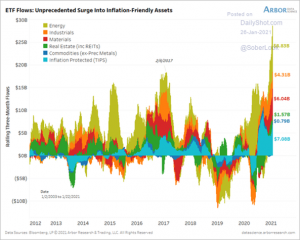

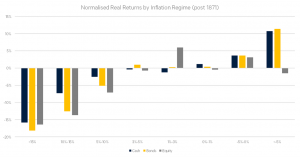

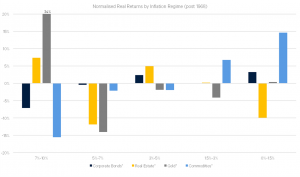

15/03/2021 The backbone of modern portfolio construction, a 70/30 growth portfolio, made up of 70% equities and 30% bonds, has served investment managers well for decades. Particularly since the mid-1980s, these portfolios have benefited from declining inflation, which has driven down bond yields, increasing the price of bonds (and other asset classes as well, including equities). This market update introduces the question of whether markets are about to reverse this multi decade trend. This could be a key issue for markets in the years ahead. The risk of a break-out in inflation seems higher than it has been in a decade. However, there are reasons to be sceptical, not least of which is the empirical experience of the past decades. Below, we present the case for and against higher inflation. The case for higher inflation So, what could drive a shift into a higher inflation regime? The key factor would be a change to the way central banks and governments think about economic policy. After the high inflation period of the 1970s and 1980s, the case was well made that central banks should aim for low and stable inflation and governments should try and balance their budget over the cycle. While governments have generally failed in their objective, central banks have been successful. Recently, there have been two key developments which suggest a change in policy could be on the cards. Both of these developments are relatively minor – but they represent an important first step in what could be a meaningful policy shift in the years to come. Many argue (probably correctly) that central banks should target higher inflation so that real interest rates can be made more negative when nominal rates are bound around zero, which would help stimulate the economy in a downturn. Once you have changed something once, it is easier to change it again. Freed from a meaningful fiscal constraint, and with the implied backing from central banks (who need to keep rates low to ensure economic growth in an over-indebted world) politicians could be tempted to spend their way to victory every election cycle. A period of higher inflation, if accompanied by reasonable growth and some fiscal repression (artificially low interest rates) would also help governments and households to bring their debts under control. Of course, this would be a bad outcome for savers and holders of bonds who would see the real value of their wealth diminish in such an environment. There are a few non-policy related candidates for a period of higher inflation in addition to the above. The below are all hypothetical but may have an impact in the decade ahead: The case for no inflation The case for no inflation is relatively easy to make. There hasn’t been any real inflation in developed market economies for the past two and a half decades. Abstracting from tax increases, major central banks have persistently delivered inflation below their respective targets. Their track record has got worse since the Financial Crisis. The key questions to ask is why this has been the case, and will it change in the future. There a few explanators for our low inflation outcomes: Market pricing and the short-term outlook There has been a little movement in terms of the market pricing a higher inflation regime, but we think there could be a long way to go. Breakeven yields (the market’s expectation of future inflation) have recovered since the Covid Recession to around normal levels. Fund flows into inflation friendly ETFs have also accelerated, but haven’t broken out. The price of gold is around 50% higher than in late 2018 but remains below the mid 2020 peak. The price of Bitcoin has exploded this year, but we think that has more to do with retail speculation than any legitimate inflation hedging. A combination of supply disruptions related to Covid-19 lockdowns and a base effect driven as some of the March 2020 sharp falls in some CPI expenditure categories falling out of the calculations could see inflation spike higher this year, which could give a kick-start to markets pricing the more medium-term risks. However, a regime shift in inflation is more of a medium to longer term consideration. Preparing for a regime change Medium and long-term considerations are best considered within the context of strategic asset allocation (SAA). The charts below show normalised real returns by asset class by inflation regime. We have data going back to 1871 for US cash, bonds and equities and post 1968 for corporate bonds, gold, commodities and real estate. The first chart shows particularly clearly that no assets perform in very high inflation environments (>10% inflation), with the potential exception of gold, which performs well when inflation is greater than 7% (no data exists for 10%+ inflation for gold). Real estate also performs well in high, but not extreme inflation environments. Interestingly, in above normal, but more contained inflation regimes (5%-7%), gold and real estate both perform poorly. This could of course reflect confounding factors (these data points were also associated with recessions and very high real interest rates). Surprisingly, commodities perform poorly in higher inflation regimes. However, digging into the data, this reflects a lead lag relationship. Commodity prices rise, then the inflation follows later. Commodity prices are subsequently hurt by the rising interest rates and recessions which the higher inflation delivered. This suggests value in a tactical investment process. What is clear from the above is that there are no “easy” asset allocation decisions. The sweet spot for major asset class real returns is low or declining inflation. The information contained in this Market Update is current as at 08/02/2021 and is prepared by Drummond Capital Partners ABN 15 622 660 182, a Corporate Authorised Representative of BK Consulting (Aust) Pty Ltd (AFSL 334906). It is exclusively for use for Drummond clients and should not be relied on for any other person. Any advice or information contained in this report is limited to General Advice for Wholesale clients only. The information, opinions, estimates and forecasts contained are current at the time of this document and are subject to change without prior notification. This information is not considered a recommendation to purchase, sell or hold any financial product. The information in this document does not take account of your objectives, financial situation or needs. Before acting on this information recipients should consider whether it is appropriate to their situation. We recommend obtaining personal financial, legal and taxation advice before making any financial investment decision. To the extent permitted by law, Drummond does not accept responsibility for errors or misstatements of any nature, irrespective of how these may arise, nor will it be liable for any loss or damage suffered as a result of any reliance on the information included in this document. Past performance is not a reliable indicator of future performance. This report is based on information obtained from sources believed to be reliable, we do not make any representation or warranty that it is accurate, complete or up to date. Any opinions contained herein are reasonably held at the time of completion and are subject to change without notice.Inflation