Market Update – December 2018

17/12/2018

Affinity Insights – Issue 7, December 2018

17/12/2018This Research Note is a summary of our full 14-page report. For the full report, please refer to your adviser.

Introduction

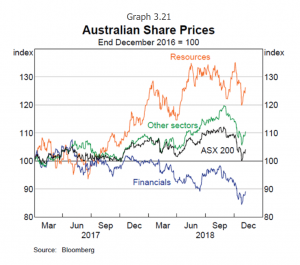

The financials sector has typically provided strong dividend yields and formed a core part of Australian investor portfolios. However, the sector has significantly underperformed the wider market through 2018. Given this, it is appropriate to analyse the 2019 sector outlook.

Table 1 illustrates the extent of underperformance of the financials sector.

Table 1: Australian Equities Sector Performance

Source: RBA Quarterly Statement of Monetary Policy, Nov 2018

2019 Outlook

Regulatory changes are likely to dominate newsflow in the near-term. Whilst the Hayne Royal Commission has shone a light on the major banks’ unethical conduct and already adversely impacted share prices, there are still several risks yet to play out and potentially impact share prices. An incoming Shorten Labor Government could re-introduce sovereign risk to the sector, with potential changes to negative gearing likely to exacerbate a property market downturn and potential changes to dividend imputation likely to reduce banks’ yield support.

The bearish investment case is extensive including:

- Royal Commission recommendations (Feb 2019),

- Federal election and potential change of Government (~May 2019), including changes to franking credits and negative gearing,

- Slowing credit growth,

- The structural impact of tighter lending and improved ethical behavior resulting in lower loan volume,

- Margin pressure,

- Rising interest rates,

- The risk of an under-provisioned bank sector coming into a housing market slowdown and with significant interest only refinancing’s to principal & interest loans, and

- Fintech disruption of staid, oligopolistic banking business models.

The bullish investment case is that current share prices already discount risks and offer attractive yields. However, the yield support argument quickly diminishes if dividends are cut, franking credits reduced or investors simply seek yield in other parts of the market without such extensive downside risks. We consider the valuation argument below.

Valuation considerations

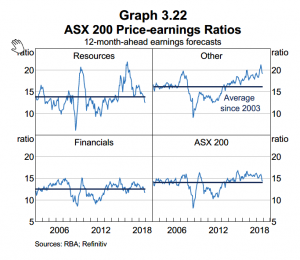

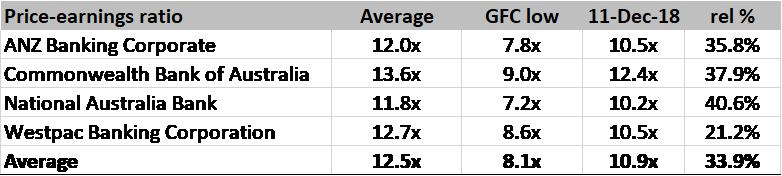

Tables 2 and 3 shows that major bank PE ratios could decline further.

Currently, the average of the 4 major banks PE ratios is 10.9x. This compares to the 8.2x bottom during the Global Financial Crisis. In other words, equity investors have applied a 34% lower PE valuation to the sector in previous years. Whilst we are not suggesting that 2019 will bring another GFC, we are highlighting that investors have marked down banks even more aggressively in previous years. Downside valuation risks remain.

Table 2: Major Bank Price-Earnings Ratios

Source: RBA Quarterly Statement of Monetary Policy, November 2018

Table 3: Major Bank Price-Earnings Ratios

Source: Bloomberg, Kennedy Partners

Sector performance considerations

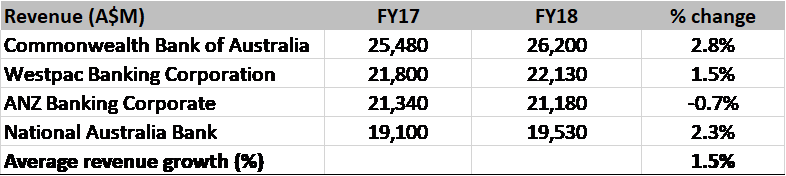

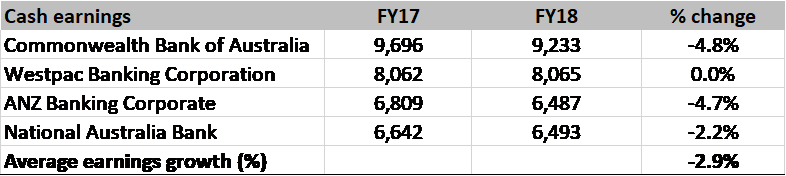

Recent results updates from the major banks highlight weak overall performance.

The sector’s average 1.5% revenue growth and -2.9% earnings growth does not augur well for the 2019 outlook as the sector confronts a number of structural and cyclical challenges.

Table 4: Major Bank Revenue Growth Trends

Table 5: Major Bank Earnings Growth Trends

Conclusion – Sector risks likely to overhang 2019 outlook

Our investment view is to remain underweight the banks sector until a sustainable earnings base becomes visible, some regulatory clarity emerges and some of the broader risks have played out.

Bank share prices are unlikely to rally in the near-term as there is no clear driver of earnings growth across the 4 major banks for 2019. Most likely, share prices could recover once investors feel they are able to look through the risks we have identified above.

However, as sector risks continue to play out through 2019, further earnings and valuation downside is possible. We remain underweight the sector.

For interested investors, we have undertaken further research in 6 Parts:

Part 1 – Sector Index weighting

Part 2 – Key risks

Part 3 – What will drive earnings growth?

Part 4 – A scorecard: current sector performance

Part 5 – Valuation considerations

Part 6 – Key Conclusions

Sincerely,

George Gabriel, CFA

Bletchley Park Capital