Market Update – July 2020

07/07/2020

Market Update – September 2020

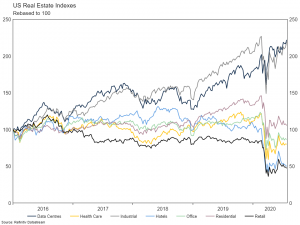

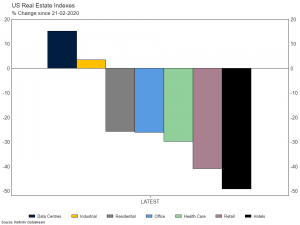

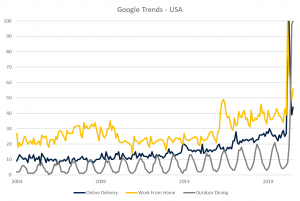

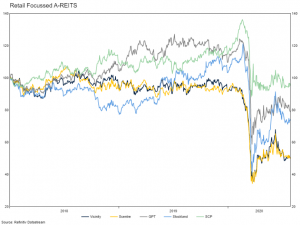

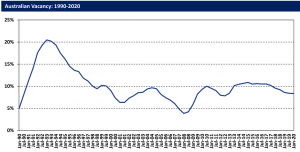

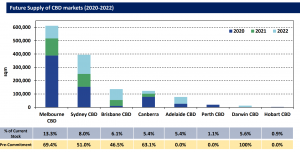

03/09/2020 Since our 2020 Strategic Asset Allocation (SAA) review in June, we have remained modestly underweight the SAA reflecting concern about prospects for the asset class in the current environment. Recently, we reduced this exposure further, as our conviction has built that real estate will underperform the broader equity market over the medium term. Below, we outline our thinking around this in more detail. Even prior to the current Covid-19 crisis, real estate was going through significant structural changes. There have been clear winners and losers. In the past five years, industrial property has benefited from the move to online spending, at a clear cost to retail centres. Offices and hotels have tread water. Multi-family residential has recovered in line with broader house prices in the US. Post Covid, performance for most subsectors has been underwhelming. The crisis has intensified the challenges posed to some sectors and created new challenges for others. There is clear evidence of forced behavioural change across most of the world in response to the virus. Of key importance is the extent to which these changes will persist on the other side. Our view is that in many ways they will. Much of the analysis below focuses on Australian property. There is still a meaningful chance that Australia will be able to suppress the virus more successfully than other parts of the world, seeing better performance from Australian real estate assets relative to those overseas. Despite this, we think the analysis below holds for Australian and overseas property. Source: Google Retail Issues with the retail sector are well known. Consumers in the USA, Canada and Australia are oversupplied with retail space. As online spending rises as a share of total, existing space has become less profitable. E-commerce penetration is still comparatively low (~10% in the USA), and few expect growth in online spending to slow. At face value, this suggests more pain ahead for bricks and mortar retail. Of key importance is the acceleration of the secular trend brought about by Covid-19. Lockdowns have introduced many, previously reticent, shoppers onto online portals. Given the convenience of online spending, it is likely that the virus will accelerate the transition towards e-commerce. There has been a concerted effort by shopping centre owners in recent years to pivot their properties towards mixed use developments as retail space is progressively given up. An empty space previously leased by a department store can be restructured into an indoor dining and entertainment space. Residential apartments and office space can be added to the footprint of a shopping centre, making better use of the land. The provision of space for health care use was also a promising pivot. Also, the projected supply of new retail assets is quite limited, meaning that on a per-capita basis, over time supply could adjust to meet structurally lower demand. In an orderly environment, this process can be undertaken without too much damage to the value of the assets. In the current environment, a sector wide pivot will be very difficult, not least because many of the activities centre owners were hoping to pivot to are restricted to prevent the spread of Covid-19. Listed retail property valuations took a battering in the March quarter sell-off and haven’t recovered much since. We have yet to see the impact of the crisis on unlisted property valuations, but we expect a similar haircut. Unlike unlisted infrastructure, there are many more comparable transactions for retail real estate, meaning medium term unlisted valuations are more likely to be marked to fair value as defined by the market. Office Unlike retail, where Covid-19 has likely accelerated an embedded trend, the outlook for office assets is more nuanced. It is clear that at the moment, working in an office environment is unsafe where there is community transmission of Covid-19. This means that absent a vaccine, effective treatment or population wide immunity, the way people will work in offices will need to change. In terms of remediation, at a minimum we expect: We think for many, at least in the short to medium term, that sits in the “too hard” basket, particularly given working from home has been relatively successful since March. As a result, over this time horizon, we think global offices will sit mostly empty. What matters most for the prospects of the sector is what happens beyond this. Ultimately, there are two potential paths, a vaccine or treatment renders offices safe, or the lack thereof, which requires meaningful changes to office buildings. Our base case is for the former. However, even in that case we think structural demand for office space will be reduced. By the time people can go back to offices in a more normal fashion, many people will have been mostly working from home for at least six months and probably longer. Some of these people will want to continue to work more flexibly in some form and businesses will need to accommodate this desire. The desire and need for collaboration in a workplace mean that a permanent remote workforce is not the most likely outcome. However, it is not unreasonable to expect a significant portion of the workforce would prefer to, and feasibly could, come into an office two to four days per week rather than five. In a worst-case scenario, if half the office workforce worked remotely half the time, office demand could fall 25%, which would be cataclysmic for the sector. In the 1990s recession the Australian office vacancy rate rose by 15 percentage points. It rose by only 6 percentage points in the Financial Crisis. Source: Property Council of Australia There is also a clear financial incentive for many corporates to offer more flexible working solutions – it reduces costs. A substantial academic literature indicating that hot desking actually reduces collaboration and makes workers unhappy hasn’t stopped corporates jumping on board because it reduces the cost of rent by 15%[1]. For lower skilled office workers, forced remote work could begin to resemble a dystopian future where employees are forced to bear the cost of office space, computer equipment and internet bandwidth. There is already software available which allows managers to “monitor” the status of remote employees by taking a photo of them using their laptop camera every five minutes[2]. This will alleviate many of the concerns of the middle management class around “lazy” workers. Higher skilled workers, able to afford a home office rather than kitchen table and with more say in how they work will engineer an altogether more pleasant working experience. In a world where a vaccine or treatment does not become available, offices will begin to look like stranded assets. Heading into the office at 5am to align with your allocated public transport seat and lift allocation, only to sit in a plexiglass enclosed cage while your mask chafes your face and the hand sanitiser peels your skin is no one’s preference. It probably also stifles the collaboration benefits heading into the office was aiming to achieve. The capex requirements required to make office assets safe in this scenario would also be significant, further weighing on net income. If the above isn’t enough, unlike retail, office valuations were also near record highs prior to the March quarter correction and the forthcoming pipeline of new office supply in Sydney (8%) and Melbourne (13%) is material relative to the current stock. Source: Property Council of Australia Industrial Industrial property has been, and remains, the bright spot for the real estate asset class. Very clearly these assets have benefited from the move towards online shopping. Demand for same day delivery has made industrial assets which can support the “last mile” of transport very attractive. However, this is not a new thematic and it is likely completely reflected in the prices of these industrial assets. Where investors used to receive a yield premium for investing in industrial assets due to the lack of land scarcity (most warehouses are not located on top of expensive real estate) and high capex requirements, industrial yields are now in the same ball park as core office space. Conclusions While we do not expect much more pain for the already very beaten-up retail property sector, we don’t really see a lot of upside in the current environment either. Office properties are likely to be challenged in coming years by higher vacancy rates driven by structural forces. While we strongly believe in the industrial thematic, we don’t see great value in this sector given yield compression in recent years. Overall, given the headwinds faced by the major sectors within the asset class, we would expect it to present an opportunity from a valuation perspective. However, this is not the case, with A-REITS trading at a 33% premium to NTA as at the end of May 2020. The valuation premium enjoyed by the asset class prior to Covid-19 likely in large part reflected the more defensive nature of the asset class. Many investors have been valuing real estate primarily relative to bond yields. When leases are long with fixed increases and low defaults, that assessment generally makes sense. However, in an increasingly volatile world, we expect this defensiveness to be tested as leases are shortened and increasingly tied to tenant turnover. [1] https://theconversation.com/the-research-on-hot-desking-and-activity-based-work-isnt-so-positive-75612 [2] https://www.businessinsider.com.au/work-from-home-sneek-webcam-picture-5-minutes-monitor-video-2020-3?r=US&IR=T The information contained in this Market Update is current as at 04/08/2020 and is prepared by Drummond Capital Partners ABN 15 622 660 182, a Corporate Authorised Representative of BK Consulting (Aust) Pty Ltd (AFSL 334906). It is exclusively for use for Drummond clients and should not be relied on for any other person. Any advice or information contained in this report is limited to General Advice for Wholesale clients only. The information, opinions, estimates and forecasts contained are current at the time of this document and are subject to change without prior notification. This information is not considered a recommendation to purchase, sell or hold any financial product. The information in this document does not take account of your objectives, financial situation or needs. Before acting on this information recipients should consider whether it is appropriate to their situation. We recommend obtaining personal financial, legal and taxation advice before making any financial investment decision. To the extent permitted by law, Drummond does not accept responsibility for errors or misstatements of any nature, irrespective of how these may arise, nor will it be liable for any loss or damage suffered as a result of any reliance on the information included in this document. Past performance is not a reliable indicator of future performance. This report is based on information obtained from sources believed to be reliable, we do not make any representation or warranty that it is accurate, complete or up to date. Any opinions contained herein are reasonably held at the time of completion and are subject to change without notice.Real Estate – Caution Amidst Secular Changes