Understanding Australia’s Director Identification Number

24/02/2022

Market Update – March 2022

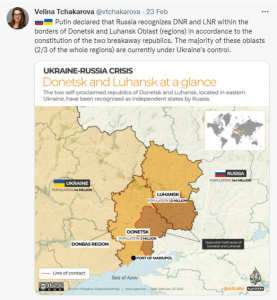

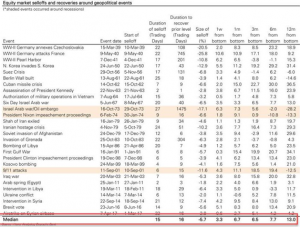

17/03/2022While the world’s attention has been focussed on tensions between Russia and Ukraine in recent weeks, we think the main issue remains inflation, interest rates, and how central banks, especially the Fed, act over the coming months and quarters. The Russian recognition of the Donetsk and Luhansk separatist regions of Ukraine as independent this week, represented an escalation in the conflict which has so far claimed around 14,000 lives since 2014 (Russia has annexed Crimea in that year and has been supporting separatists in Eastern Ukraine since). Large parts of Donetsk and Luhansk are controlled by Ukraine (see below), and Russia certainly has enough armed forces on the border to take both the regions in full or move further into Ukraine proper (both of which would move the conflict towards the more traditional definition of war). However, in the grand scheme of markets, unless NATO countries are drawn into the conflict (which is exceptionally unlikely), we think the impact will be relatively limited. More widespread conflict would increase energy prices, (which drags on growth and earnings), and increased sanctions which will prolong supply chain woes, keeping inflation elevated a little longer. Specific, obvious examples include: Markets do tend to sell first and ask questions later on geopolitical events such as this, however, they also recover quickly. There are 11 such events listed below since 1991. In seven of them indices had fully recovered in one month, and nine in three months. Portfolio Positioning Our portfolios are currently underweight global equities, largely reflecting concern about higher interest rates and slowing growth over the coming year. This has provided a buffer for recent market volatility. If all we were concerned about was the Russian invasion, recent market weakness would represent a buying opportunity, however, risks from the Fed still dominate. This is prepared by Drummond Capital Partners (Drummond) ABN 15 622 660 182, a Corporate Authorised Representative of BK Consulting (Aust) Pty Ltd (AFSL 334906). It is exclusively for use for Drummond clients and should not be relied on for any other person. Any advice or information contained in this report is limited to General Advice for Wholesale clients only. The information, opinions, estimates and forecasts contained are current at the time of this document and are subject to change without prior notification. This information is not considered a recommendation to purchase, sell or hold any financial product. The information in this document does not take account of your objectives, financial situation or needs. Before acting on this information recipients should consider whether it is appropriate to their situation. We recommend obtaining personal financial, legal and taxation advice before making any financial investment decision. To the extent permitted by law, Drummond does not accept responsibility for errors or misstatement of any nature, irrespective of how these may arise, nor will it be liable for any loss or damage suffered as a result of any reliance on the information included in this document. Past performance is not a reliable indicator of future performance. This report is based on information obtained from sources believed to be reliable, we do not make any representation or warranty that is accurate, complete or up to date. Any opinions contained herein are reasonably held at the time of completion and are subject to change without notice. .Ukraine & Russia